Wage Laws

Wage laws refer to the body of law that regulates federal wage standards for full- and part-time employees in the Unites States, including minimum wage, overtime and meal breaks, although much of the wage and hour law is at the state level, which means requirements may vary on a state-by-state basis. Federal wage laws are overseen by the U.S. Department of Labor (DOL) and its Wage and Hour Division (WHD), and are designed to ensure that workers are treated fairly, although the laws are in place to protect the interest of employers as well. The Fair Labor Standards Act (FLSA) establishes federal standards for wages and overtime pay, as well as recordkeeping and child labor standards, which affect most full- and part-time workers in the private sector, and in Federal, State, and local governments.

Federal Wage and Hour Laws

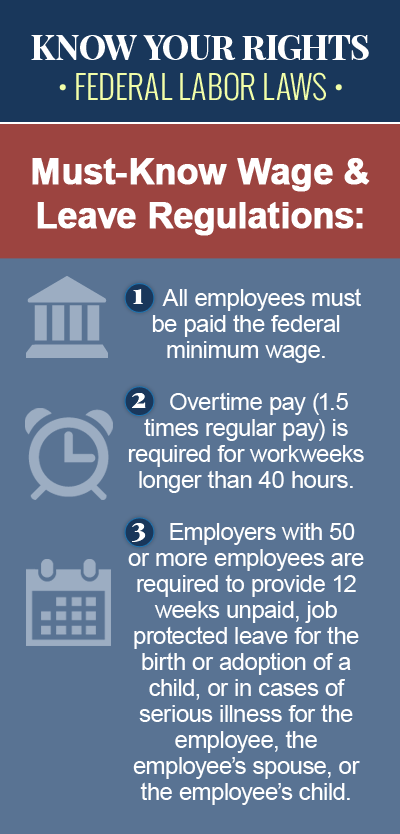

Wage laws in the United States require employers to pay covered employees who are not otherwise exempt at least the federal minimum wage, and one-and-one-half-times the regular rate of pay for overtime hours. Effective July 24, 2009, the federal minimum wage for covered, nonexempt employees is $7.25 per hour. However, many states have their own minimum wage laws, and in states that have approved a minimum wage that is higher than the federal standard, employers in those states must comply. For nonagricultural operations, the FLSA restricts the number of hours that children under 16 can work, and prohibits the employment of children under 18 in jobs that are considered too dangerous. For agricultural operations, the Act forbids the employment of children under the age of 16 during school hours, and also in jobs that are considered too dangerous.

Overtime Hours and Pay

The U.S. government does not place limits on the number of hours adults are permitted to work per week, but, in addition to paying at least the minimum wage, the FLSA requires most employers to pay overtime – one-and-one-half-times the regular rate of pay – to employees who work more than 40 hours in a given workweek. The only time employers are excused from paying overtime to employees who work more than 40 hours in a given workweek, is if the employee meets certain exemptions, described below.

Exempt vs. Non-Exempt Employees

A major factor in federal overtime standards is whether an employee is considered exempt or non-exempt, a classification that depends on their salary and the type of work they do. If an employee is exempt, which may be the case with executive, administrative, and professional employees, outside sales employees, and computer professionals, he or she isn’t subject to the FLSA’s overtime requirements, and may not be entitled to overtime pay under the Fair Labor Standards Act. Non-exempt employees, on the other hand, are entitled to one-and-one-half-times their regular rate of pay for any hours they work over 40. Beginning on December 1, 2016, new overtime regulations will go into effect that increase the salary threshold for exemption, from $455 per week to $913 per week (or $23,660 to $47,476 per year). For exempt highly compensated employees, the total annual compensation has been set at $134,004, up from $100,000.

Investigating Wage Law Complaints and Violations

The hour and wage provisions of the FLSA are interpreted and enforced by the Department of Labor, which investigates complaints filed on behalf of employees, and sometimes sues when it uncovers wage and hour law violations. Many states also have agencies tasked with enforcing labor laws at the state level, and investigating complaints by employees who believe their rights have been violated by their employer. Contact a knowledgeable employment law attorney today, if you believe you have been the victim of a wage and hour law violation.