Illinois Wage and Hour Laws

Illinois wage and hour laws protect the rights of employees across the state and establish the standards for minimum wage, “tipped” wages, meal and rest breaks, and other wage and hour concerns. These labor laws also offer civil remedies for Illinois employees whose employers fail to pay them the wages they are due. If your employer in Nevada has paid you less than minimum wage, or if you were promised certain wages or benefits that you haven’t been paid, you may have a wage and hour claim against your employer. Contact an experienced Illinois employment law attorney today to discuss your options for legal recourse.

Illinois Minimum Wage Requirements

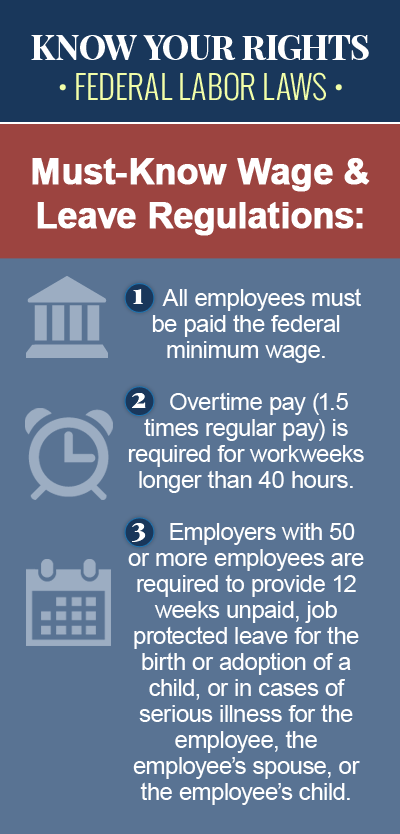

The Illinois Department of Labor minimum wage law requires employers in Illinois to pay nonexempt employees 18 years of age and older an hourly wage of at least $8.25, while employees under 18 can be paid $.50 per hour less than the adult minimum wage, at an hourly rate of $7.75. This is compared to the federal minimum wage requirement, which sets the federal minimum wage at $7.25. Under federal law, employers subject to two different minimum wage requirements, like Illinois, are required to follow the law that is most generous to the employee, or that results in the employee being paid the higher wage. As such, employers in Illinois must follow the state minimum wage requirement.

Minimum Wage for Tipped Employees in Illinois

Under Illinois labor law, employers are permitted to count tips towards the hourly wage of employees in occupations where tips are customarily received – in other words pay them a lower hourly rate – so long as the credit for tips does not exceed 40% of the applicable minimum wage. The current minimum wage for tipped employees in Illinois is $4.95 for workers 18 years of age and older, and $4.65 for workers under 18. Employees receiving a lower “tipped” wage must receive at least $20 per month in tips, and employers must ensure that these employees are receiving the standard minimum wage when the tips they earn are combined with their hourly wages.

Meal and Rest Breaks in Illinois

Illinois law requires employers to give employees who are expected to work 7 ½ continuous hours or more a meal period of at least 20 minutes, which can be unpaid, and the meal period must be given to an employee no later than five hours after beginning work. This meal period must be granted for each continuous 7 ½ hours the employee is expected to work, so employees scheduled to work 15 hours in one continuous shift must be granted two 20-minute meal periods. On the other hand, Illinois does not have any laws regulating rest breaks for employees, thus the federal standard applies. According to federal law, employers in Illinois are not required to provide employees with a rest break, but if they choose to do so, the break, usually 20 minutes or less, must be paid. Employees in Illinois under the age of 16 must be granted a meal period of at least 30 minutes if they are scheduled to work more than five consecutive hours.

Contact an Illinois Wage and Hour Attorney Today

If you are an employee in Illinois, there are state and federal labor laws in place that protect your right to be paid a rate that reflects state minimum wage requirements, and that provide other protections in regards to your rights under wage and hour law. If you believe you have been the victim of a labor law violation in Illinois, consult a knowledgeable Illinois employment law attorney today for legal help. You may have grounds to file a wage and hour claim against your employer, which can help you recover the wages you are due, plus penalties, punitive damages, attorney’s fees, and other additional damages.