Illinois Employment Law

Employment law is a broad area of the law that covers nearly every aspect of the employee/employer relationship, with special provisions regulating minimum wage and overtime wages, governing an employee’s right to disability benefits or health benefit continuation coverage, and protecting employees from discrimination in the workplace, sexual harassment, wrongful termination, and other unlawful employment practices. The federal Fair Labor Standards Act (FLSA) covers many of these issues, but there are also state laws in place that provide additional protections for employees in Illinois. If you believe you have been the victim of a labor law violation in Illinois, contact a knowledgeable employment law attorney today to discuss your options for legal recourse.

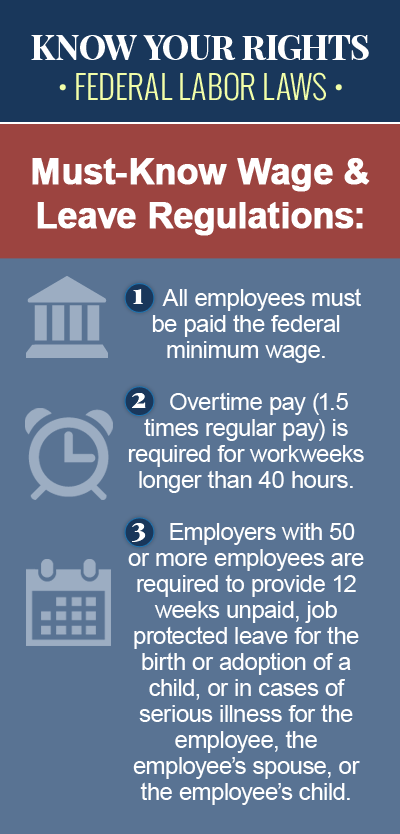

Wage and Hour Law

Federal and state wage and hour laws govern the payment of minimum wage to nonexempt employees in Illinois, as well as other wage and hour concerns, including meal periods and rest breaks. Under Illinois law, nonexempt employees are entitled to a minimum wage of $8.25 per hour, compared to the federal minimum wage requirement of $7.25, and employees who are expected to work 7 ½ continuous hours or more are entitled to an unpaid meal period of at least 20 minutes. Illinois employers are not required to provide employees with a rest break, but if they choose to do so, the break, usually 20 minutes or less, must be paid.

Unpaid Wages and Overtime

Illinois wage and hour laws also govern the payment of a premium wage to employees who work overtime hours, and under Illinois law, nonexempt employees who work more than 40 hours in a given workweek are entitled to an overtime rate of one-and-one-half-times their regular rate of pay for every hour worked over 40. Employees who are denied overtime wages by their employer may be entitled to financial compensation for lost wages and other damages, which they can pursue by filing a wage and hour claim against their employer.

Workplace Discrimination

Discrimination in the workplace is against the law in Illinois, and there are federal and state antidiscrimination laws in place that prohibit employers from making employment decisions that have a disproportionate adverse impact on members of a protected class. Discrimination can take place in any part of the employment relationship, including hiring, promotions, benefits, pay, demotions, discipline or firing (wrongful termination), and employees and job applicants in Illinois are safeguarded against employment discrimination based on protected characteristics like sex, race, national origin, religion, genetic information and disability.

Wrongful Termination

Like most other states, Illinois is an at-will employment state, which means employers in Illinois have the right to fire an employee for any reason, or no reason at all, and without any notice. However, there are state and federal wrongful termination laws in place that make it illegal for an employer to fire an employee on the basis of a protected characteristic, such as race, religion, sex or national origin, in retaliation for the employee exercising his rights, or in violation of public policy or an oral, written or implied employment contract. An employee who is fired for discriminatory or retaliatory reasons in Illinois may have a wrongful termination claim against his employer.

COBRA Continuation Coverage

Federal COBRA laws allow employees who work for companies in Illinois with 20 or more employees to temporarily extend their employer-sponsored healthcare coverage if they lose their health benefits due to a qualifying event, such a job loss or a reduction in work hours. There is also a state “mini-COBRA” law in Illinois that offers a similar extension of benefits to employees who work for companies with between two and 19 employees. In some cases, spouses, former spouses and dependents may also qualify for continuation coverage under federal or state COBRA laws, if they lose their coverage due to divorce, legal separation, death of the covered employee, or a loss of “dependent” status under the health plan’s provisions.

SSI/SSDI Disability Benefits

Disabled, elderly or blind individuals in Illinois who are no longer able to work may qualify for disability benefits under the federal Supplemental Security Income (SSI) or Social Security Disability Insurance (SSDI) programs, which provide monthly cash payments that are administered by the Social Security Administration. While SSI benefits are based on financial need, SSDI benefits are only available to individuals who worked long enough and paid Social Security taxes before becoming disabled. Illinois residents who are awarded SSI benefits may also qualify for a supplemental payment from the state of Illinois.

To learn more about Federal US employment laws, browse the following topics: