Arizona Wage and Hour Laws

In Arizona, the relationship between employees and employers is protected by both state and federal laws that dictate the minimum wage rate employees across the state are entitled to, when they must be paid, and how many rest and meal breaks they qualify for during the day, among other employee rights. If you believe you have been the victim of a wage and hour violation in Arizona, including being paid a rate lower than the state’s required minimum wage, contact an experienced Arizona employment law attorney today for legal help. You may have grounds to file a claim against your employer, in order to recover damages for wages and any other employer-sponsored benefits you may be entitled to, and having a qualified lawyer on your side can significantly improve your chances of winning your claim.

Arizona Minimum Wage Requirements

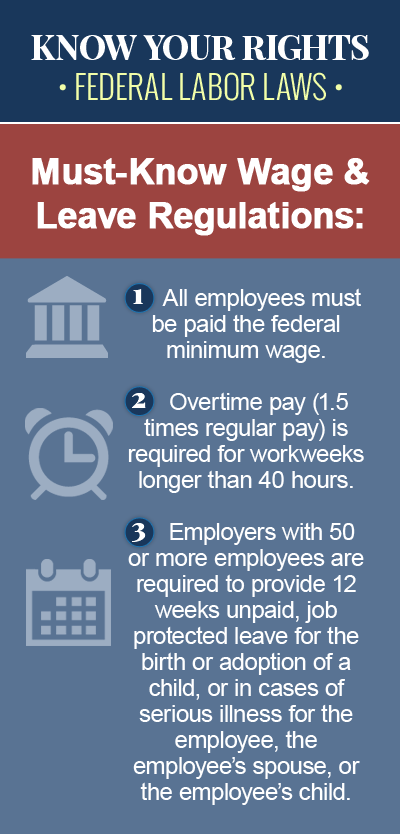

The federal wage and hour law is called the Fair Labor Standards Act (FLSA), but most states, including Arizona, have their own wage and hour laws, and any employers who are subject to more than one labor law are required to follow the law that is most generous to the employee. For example, beginning January 1, 2017, the minimum wage requirement in Arizona is $10.00 an hour, which means all nonexempt employees in the state are entitled to an hourly rate of at least $10.00, compared to the federal minimum wage requirement, which is only $7.25 per hour. The minimum wage requirement in Arizona is scheduled to increase to $10.50 an hour in 2018, $11.00 an hour in 2019, and $12.00 an hour in 2020.

Minimum Wage for Tipped Employees

Arizona law allows employers to apply tips and gratuities towards an employee’s hourly rate, in order to reduce the minimum wage, and for “tipped” employees in Arizona, the minimum wage requirement is only $4.90 an hour. A tipped employee is any employee who customarily and regularly receives tips, and employers in Arizona are permitted to pay these employees the lower hourly rate, so long as the tips earned plus the employee’s regular hourly wage equals at least the state minimum wage requirement of $10.00 an hour.

Meal Breaks and Rest Periods for AZ Employees

The state of Arizona does not have any laws that require an employer to provide meal or rest breaks for employees, nor does the federal Fair Labor Standards Act. However, if an employer chooses to provide employees with rest breaks lasting less than 20 minutes, the breaks must be paid. Meal or lunch periods lasting 30 minutes or more do not need to be paid, so long as the employee is free to do as he wishes during the period, without having any mandatory work requirements to tend to.

An Experienced Attorney Can Help

In Arizona, you can only file a wage and hour claim against your employer if you have worked and not received the wages you are owed. When wages owed are no more than $5,000.00, and the accrual of those unpaid wages does not exceed one year, the employee may file a wage and hour claim with the State Department of Labor, which regulates wage and hour laws in Arizona. Employees also have the option of filing a civil claim against their employer to recover the wages they are owed. If you have been denied the required minimum pay at work, or if you have been the victim of another wage and hour violation in Arizona, consult an experienced employment law attorney today to discuss the possibility of filing a wage and hour claim against your employer.