Texas Wage and Hour Laws

Texas wage and hour laws govern nearly every aspect of the employee/employer relationship in Texas, establishing requirements for minimum wage, determining what counts as “time worked,” and indicating whether or not employees should be paid meal and rest breaks. In many cases where there are no specific laws at the state level, Texas employers are required to follow federal wage and hour laws governing that particular issue. If you believe you have been the victim of a wage violation in Texas, contact a knowledgeable employment law attorney today for legal help. You may have grounds to file a wage claim against your employer, in order to recover damages for your losses.

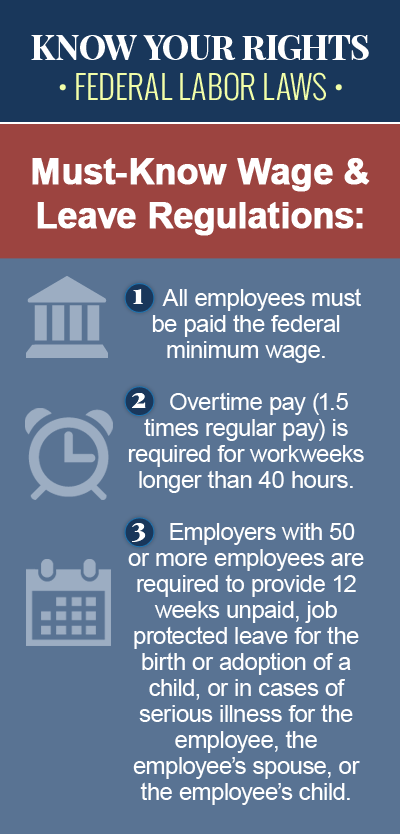

Texas Minimum Wage Requirements

Unlike other many other states that have established a minimum wage rate that is higher than the federal minimum wage, Texas has adopted the federal minimum wage rate of $7.25 per hour, which means non-exempt employees are entitled to a rate of pay of at least $7.25 for every hour worked. The primary exemption from the Texas Minimum Wage Act is for any person covered by the federal Fair Labor Standards Act (FLSA), and other exemptions include:

- Inmates

- Family members

- Professionals, public officials or salespersons

- Employment in, of or by religious, charitable, educational or nonprofit organizations

- Amusement and recreational establishments

- Certain youths and students

- Sheltered workshops

- Dairying and production of livestock

- Non-agricultural employers not liable for state unemployment contributions

- Domestics

With specified restrictions, employers in Texas are permitted to count tips and the value of meals and lodging toward the minimum wage requirement. For instance, the FLSA permits employers to pay certain employees who regularly receive more than $30 a month in tips “tipped” wages, as long as the tips they earn plus their hourly rate of pay equals or exceeds the federal minimum wage requirement of $7.25 for each hour worked. The current federal minimum wage for tipped employees is $2.13.

Paid Breaks or Lunch Period in Texas

The Texas Workforce Commission (TWC) investigates wage claims under the Texas Payday Law, Chapter 61 of the Texas Labor Code, including claims related to compensable time, payment delivery, pay periods and deductions from wages. In terms of compensable time, the Texas Payday Law requires that workers in Texas be paid for all time worked, or “all the time during which an employee is necessarily required to be on the employer’s premises, on duty or at a prescribed work place.” The Payday Law does not address the issue of meal breaks or rest breaks, which are left to the discretion of the employer, but the U.S. Department of Labor requires the following:

- Meal breaks (a break of 30 minutes or longer for the purpose of eating a meal), where the employee is fully relieved of duties, do not have to be paid.

- If rest breaks or coffee breaks of 20 minutes or less are given, they must be paid, as they are considered to be beneficial to the employer (they promote productivity and efficiency on the part of the worker).

Also, under the Texas Payday Law, employers in Texas are not required to offer employees fringe benefits, such as holiday pay, vacation pay or other pay for hours not worked, nor are they required to pay additional wages to employees who work on these days.

Contact a Texas Employment Law Attorney for Legal Help

Filing a wage and hour claim in Texas can be a confusing and frustrating process, especially for those without extensive knowledge of the intricacies of Texas labor laws. If you believe your employer has failed to pay you the hourly rate you deserve (i.e. you are being paid below the minimum wage), or if you are owed wages as a tipped employee, or for paid coffee or rest breaks, you can file a wage claim with the Texas Workforce Commission, which regulates wage and hour laws in Texas. An experienced employment law attorney can ensure that your rights are protected as an employee in Texas, and help you recover the wages you are owed from your employer.