Texas Unpaid Wages and Overtime

Despite laws at the federal and state level governing how and when employers must pay employees for time worked, overtime, and any supplemental benefits, unpaid wage claims in Texas are common. If your employer has failed to pay your wages under Texas law, you can choose to file a wage claim with the Texas Workforce Commission, or bring a private lawsuit against your employer to recover unpaid wages and other related damages. Either way, it’s in your best interest to contact an employment law attorney who has experience handling such claims in Texas, in order to ensure that you understand your eights as an employee, and to improve your chances of recovering the wages you are owed.

Understanding Texas Laws for Unpaid Wages

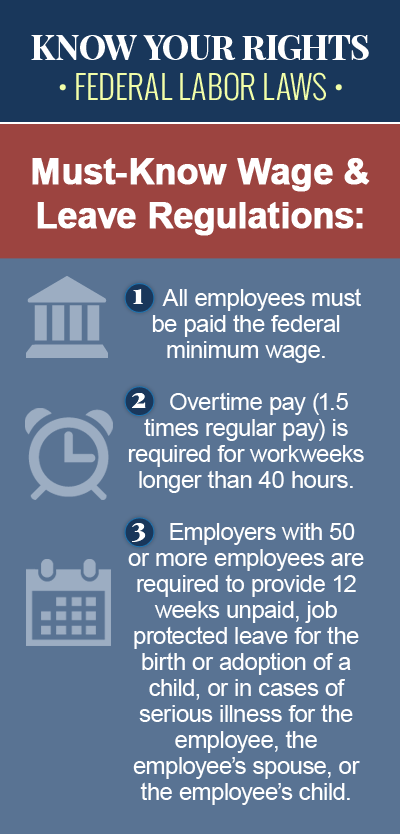

The Texas Minimum Wage Act establishes a minimum wage for non-exempt employees and provides civil remedies for violations of the Act, including unpaid wages. Under Texas law, employees who are exempt from the overtime provisions of the federal Fair Labor Standards Act (FLSA) must be paid at least once a month, while other employees must be paid at least twice a month. If an employer does not designate specific paydays, the paydays are understood to be the first and 15th day of every month. An employee who quits must be paid in full at the next regular payday, and terminated employees must be paid in full within six days. If, for any reason, an employee is not paid on a payday, the employer must pay the wages due on another business day as requested by the employee.

Texas Overtime Laws

There are no laws at the state level that govern the payment of overtime to employees in Texas, which means federal overtime laws apply. Under the FLSA, there are no limits to the number of hours an employer may require an employee to work in a single workday or workweek, but the employer is required to pay the employee an overtime rate of one-and-one-half-times their regular rate of pay for all hours worked over 40 in a given workweek, unless the employee is otherwise exempt from the FLSA’s overtime requirements. Under federal wage law, as long as a non-exempt employee doesn’t work more than 40 hours in a workweek, the employer is not required to pay him overtime for working more than eight hours in one workday, or for hours worked on a Saturday, Sunday, or holiday.

Filing an Unpaid Wages Claim in Texas

The Texas Workforce Commission (TWC) administers the Texas Payday Law, which protects the rights of employees in recovering unpaid wages for regular hours worked or overtime hours. An employee in Texas who believes he or she has not been paid all wages due may submit a wage claim with the TWC no later than 180 days after the date the wages were originally due. In Texas, it is illegal for an employer to:

- Fail to pay wages after the TWC indicates they are due

- Hire or continue to employ a worker with the intent of withholding due wages

If you believe you have been paid at a rate lower than the law requires in Texas, you may have grounds to take legal action against your employer. Under Texas wage and hour law, an employee has two years from the date wages were due to file a lawsuit against his employer to recover the unpaid wages, plus an additional amount as liquidated damages, attorney’s fees and court costs.

An Experienced Texas Employment Law Attorney Can Help

If you believe you have been the victim of a wage violation in Texas, meaning you are owed wages for regular hours worked, overtime hours, or any supplemental benefits, do not hesitate to contact a Texas wage and hour law attorney for legal help. You have only a short period of time during which are you permitted to file a claim with the Texas Workforce Commission or to bring a lawsuit against your employer for unpaid wages, and waiting can affect your chances of recovering the wages you are owed. Consult a knowledgeable employment law attorney in Texas today to explore your possible compensation options.