Texas Employment Law Help Center

There are federal laws in place that set the standards for the rights of employees and employers across the United States, but much of the law protecting workers from unfair labor practices, unsafe working conditions and discriminatory treatment is governed at the state level. Labor laws specific to Texas that, among other things, dictate how and when an employee must be paid, determine what benefits Texas residents are entitled to for disabilities that prevent them from securing gainful employment, and offer civil remedies for wrongful termination and discrimination in the workplace. If you are a resident of Texas, and you believe you have been the victim of a labor law violation on the part of your employer, contact an experienced employment law attorney as soon as possible to discuss your options for legal recourse.

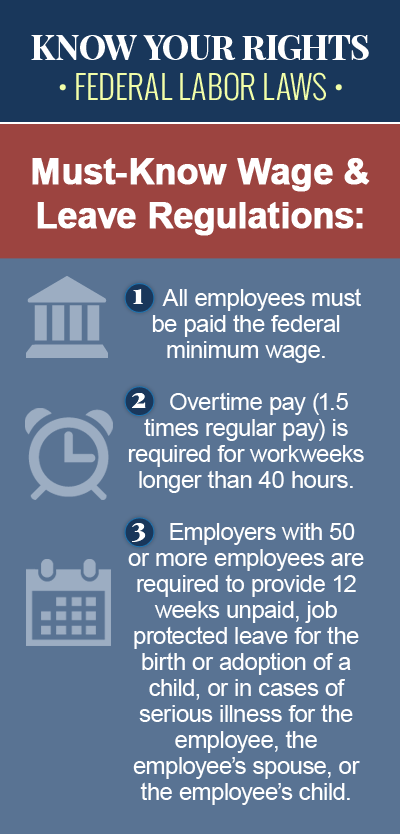

Wage and Hour Laws

Some states have established their own minimum wage requirements that exceed the federal standard, but Texas has adopted the federal minimum wage rate of $7.25 per hour, which means nonexempt employees in Texas are entitled to an hourly rate of pay of at least $7.25. Per the Fair Labor Standards Act (FLSA), Texas employers are permitted to pay certain tipped employees a lower hourly rate, as long as the tips they earn plus their hourly rate of pay equals at least the federal minimum wage rate. Any employee in Texas who is paid less than the federal minimum wage may have a wage and hour claim against his employer.

Unpaid Wages and Overtime

There are no state-specific laws in Texas that govern the payment of overtime wages to their employees, which means employers in Texas are subject to the federal standards for overtime pay, which entitle nonexempt workers to one-and-one-half-times their regular rate of pay for any hours worked over 40 in a given workweek. Federal law does not require an employer to pay an employee overtime for working more than eight hours in a workday, or for hours worked on a Saturday, Sunday or holiday, as long as the hours don’t exceed 40 in one week. Employees in Texas who are owed back pay for any regular or overtime hours may have grounds to file an unpaid wages claim against their employer.

Discrimination in the Workplace

There are workplace discrimination laws in place in Texas that make it unlawful for employers to engage in discriminatory employment practices that have a disproportionate adverse impact on members of a protected class. Protected characteristics in Texas include color, race, disability, religion, sex, age and national origin, and any employer who fires, fails to hire, limits, segregates or otherwise discriminates against an employee or applicant based on a protected characteristic may be held liable for any loss of wages and employer-provided benefits the employee incurred as a result of the discrimination.

Wrongful Termination

Like most other states, Texas is an at-will employment state, which means Texas employers can fire their employees at any time, for any reason, or for no reason at all. However, there are laws at the federal and state level that prohibit employers in Texas from firing an employee on the basis of a protected characteristic, such as race, religion, disability or national origin. Wrongful termination laws also make it illegal for an employer to fire an employee for reasons that violate a worker’s employment contract or public policy, and a wrongful termination claim may be brought by an employee who is fired for retaliatory reasons, such as refusing to commit a crime, or for reporting workplace discrimination, wage and hour violations, or other unlawful behavior.

COBRA Continuation Coverage

The federal Consolidated Omnibus Reconciliation Act (COBRA) allows employees who have lost their employer-sponsored healthcare coverage due to voluntary or involuntary job loss, or a reduction in work hours, to temporarily extend their health benefits for a certain period of time, while they are between jobs. COBRA coverage only applies to employers with 20 or more employees, but the state of Texas also offers continuation coverage for employers with two to 19 employees, allowing these employees to extend their group health plan for an additional six months.

SSI and SSDI Disability Benefits

Supplemental Security Income (SSI) and Social Security Disability Insurance (SSDI) are federal programs providing monthly benefits to disabled individuals who are no longer able to work because of a physical or mental disability that is expected to last 12 months or result in death. SSI benefits are paid to aged, blind or disabled individuals who have limited income and assets, to meet basic needs for shelter, clothing and food, while SSDI benefits are paid to disabled individuals who are “insured,” or who have worked long enough and recently enough and have paid Social Security taxes.

To learn more about Federal US employment laws, browse the following topics: