There are laws in New York that protect the rights of employees against deceptive employers who may attempt to withhold all or part of an employee’s regular or overtime wages, fail to pay agreed-upon wage supplements, or take illegal deductions from an employee’s wages. As an employee in New York, you can file a claim with the Department of Labor if your employer fails to pay you all or part of the wages you rightfully earned, or you can bring a claim in court to collect your unpaid wages and any supplemental benefits owed by your employer. Consult a reputable New York employment law attorney today to discuss your possible compensation options.

New York Overtime Pay Laws

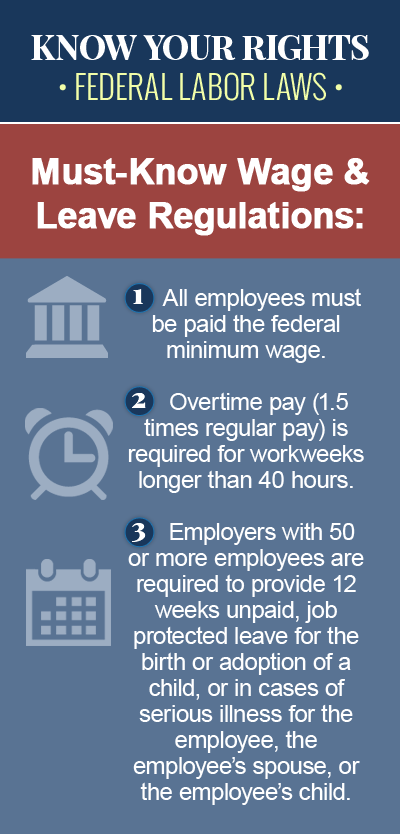

Under New York labor laws, employers are required to pay overtime wages to employees, unless otherwise exempt, at the rate of one-and-one-half-times the employee’s regular rate of pay, for each hour worked in excess of 40 hours in one workweek for nonresidential employees, and in excess of 44 hours per week for residential employees. New York provides an overtime exemption for bona fide executive, administrative and professional employees. New York overtime laws also require certain employers, including those operating factories, hotels, restaurants, and mercantile establishments, to provide employees with at least 24 consecutive hours of rest in any calendar week. For employees of resort hotels in New York, if the employee works seven consecutive days, the hours worked on the seventh day are considered overtime hours. It should be noted that any employee not covered under the minimum wage law is also not covered by the overtime wage provisions.

Unpaid Wages in New York

The term “unpaid wages” refers to any wages your employer promised you – verbally or in writing – and failed to pay, including wages for hours worked, vacation pay, holiday pay, bonus pay, expenses, sick pay, or reimbursement for medical bills. The Department of Labor is tasked with helping collect unpaid wages, benefits or wage supplements owed to workers who have not received the minimum wage as dictated by state or federal labor laws, or who have not received benefits and wage supplements that were agreed upon, and will investigate claims for unpaid wages, withheld wages and illegal deductions. You may be entitled to unpaid wages if your employer:

- Didn’t pay you for all hours worked

- Gave you a check you couldn’t cash

- Didn’t pay you for training

- Kept some, or all of your tips

- Deducted wages other than federal or state taxes

- Owes you for uniform, spread of hours, or call in pay

- Paid you less than the current minimum wage rate

- Lowered your rate of pay without notifying you first

- Didn’t pay you overtime for more than 40 hours worked in one workweek

New York Meal or Rest Break Laws

In regards to meal or rest breaks, New York labor laws require that every employee who works a shift of more than six hours, unless otherwise exempt, shall be allowed at least 30 minutes for the noonday meal, between 11:00 a.m. and 2:00 p.m. In addition, every employee who works a shift that begins before 11:00 a.m. and continues later than 7:00 p.m. shall be allowed an additional meal period of at least 20 minutes, between 5:00 p.m. and 7:00 p.m. New York labor laws also require that every employee who works a shift of more than six hours starting between the hours of 1:00 p.m. and 6:00 a.m. shall be allowed at least 60 minutes for a meal break when employed in or in connection with a factory, and 45 minutes for a meal break when employed in or in connection with a mercantile or other covered occupation, at a time midway between the beginning and end of their shift.

Contact a NY Employment Law Attorney for Help

If your employer owes you wages for hours worked or overtime hours, and you have asked him or her to pay you, you may be entitled to file a claim with the New York State Department of Labor, in order to recover your unpaid wages. The Department will investigate your claim and attempt to help you collect the unpaid wages. However, if that is unsuccessful, it may be beneficial to have an experienced New York employment law attorney already on your side, one who is familiar with your case and can inform you of your legal options. You may have grounds to bring a court case in order to recover the wages you are owed, plus attorneys’ fees, and any additional damages. There are strict time limits in which charges of wage and hour violations must be filed though, so it’s important to contact a knowledgeable lawyer as soon as possible.