New York Employment Law

Employment law is a broad term that encompasses all areas of the law that govern employer/employee relationships, and while there are federal standards for many aspects of employment law, also known as labor law, much of the law is regulated at the state level, with standards and requirements specific to employers in New York State. Both federal and state governments have enacted laws that protect employees from discriminatory treatment, unsafe work conditions, and unfair labor practices, and employers who violate these laws should be held liable for their actions. If you believe you have been the victim of an employment law violation in New York, in regards to wrongful termination, workplace discrimination, unpaid wages, or disability benefits, contact a knowledgeable New York employment law attorney to discuss your options for legal recourse.

Wage Law

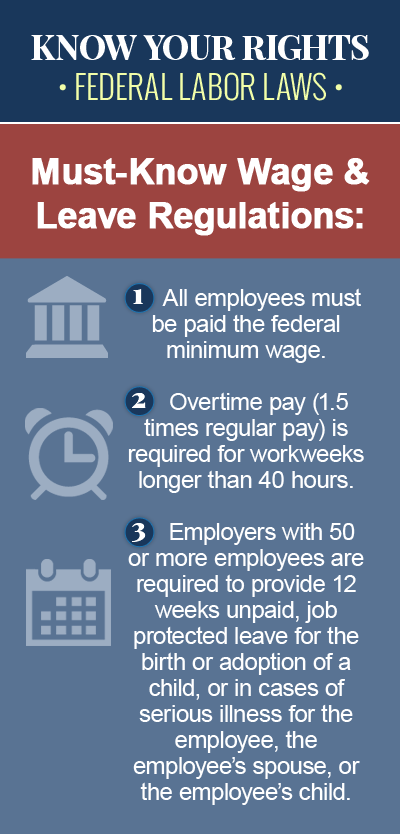

Wage laws in the United States are administered and overseen on a federal level, but each state also sets its own wage law standards. For example, while the federal minimum wage requirement is $7.25 per hour, the state minimum wage requirement for most of New York State is $9.70 per hour, effective December 31, 2016, and an employer in New York who is subject to more than one minimum wage law is required to comply with the wage requirement that is most generous to the employee. Exempt employees to whom the state minimum wage law does not apply include: babysitters, taxi drivers, outside salespersons, members of religious orders, staff counselors in children’s camps, employees of student or faculty associations, et cetera.

Unpaid Wages/Overtime

According to New York labor laws, employers are required to pay overtime wages to nonexempt employees at the rate of one-and-one-half-times their regular rate of pay, for every hour worked in excess of 40 hours in one workweek. New York also has laws in place that dictate the appropriate course of action for employees to recover unpaid wages, which may include wages for hours worked, holiday pay, expenses, bonus pay, vacation pay, sick pay, reimbursement for medical bills, or any other wages that the employer promised – verbally or in writing – and failed to pay.

Discrimination

Workplace discrimination remains a serious problem in New York and across the country, and can come in many different forms, occurring when a member of a protected class is treated differently than his or her peers. According to New York State law, protected classes in regards to employment include, but are not limited to: race, religion, national origin, color, sex, age, citizenship status, marital status and disability. For example, if an African-American employee is repeatedly passed up for a promotion despite being qualified for the job, he or she may have grounds to file a claim for workplace discrimination.

Wrongful Termination

In nearly every state, the law presumes that employment relationships are “at will,” meaning employers and employees are free to terminate the relationship at any time and for any reason. However, to be “wrongfully terminated” is to be discharged from employment for an illegal reason, which may involve a contractual breach or a violation of federal anti-discrimination laws. Under federal law, employees may not be terminated on the basis of their gender, race, ethnic background or disability. It is also against the law for an employee to be terminated for lodging a complaint against his or her employer, or for bringing his or her employer’s wrongdoing to light as a whistleblower.

COBRA

Employees in New York State who lose their jobs or have their hours at work reduced may be able to extend their health insurance coverage under the federal law known as COBRA (Consolidated Omnibus Budget Reconciliation Act of 1985) and New York’s “Mini-COBRA” law. This continued coverage is designed to increase benefits and limit the number of New York employees without health insurance, and may be extended to all employees in employer-provided insured health plans for up to 36 months – twice as long as the 18 months typically allowed by federal law.

SSI/SSDI

Supplemental Security Income (SSI) and Social Security Disability Insurance (SSDI) are federally-funded programs designed to provide financial benefits to individuals who are unable to work because of a physical or mental disability. While SSDI benefits are reserved for adults who worked long enough in the past and paid Social Security taxes, and who now have a disability that prevents them from earning an income, SSI benefits are available to aged, blind and disabled individuals who have little or no income, and are intended to meet basic needs for clothing, food and shelter.

To learn more about Federal US employment laws, browse the following topics: