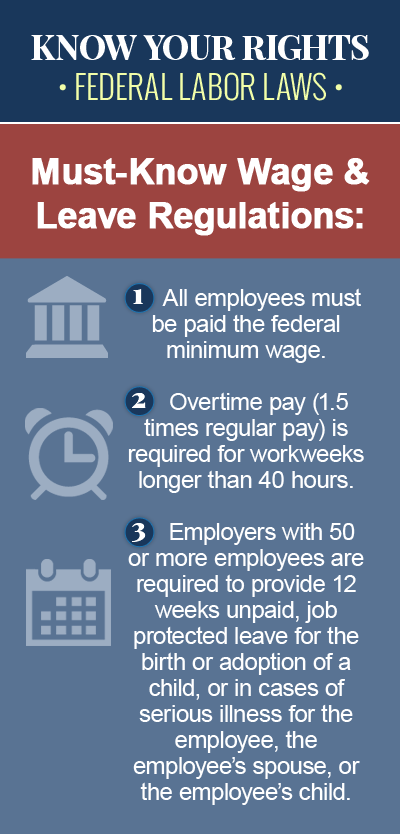

Wage and hour laws in New York determine the basic standards for employee pay and time worked, in regards to such issues as minimum wage, tips, meal and rest breaks, what counts as time worked, when workers must be paid, and so on. While federal wage and hour laws are traditionally administered and overseen by the Department of Labor (DOL), and regulated by the Fair Labor Standards Act (FLSA), much of the wage and hour law is at the state level, and such standards often vary state by state. If you believe you may be entitled to additional pay in order to meet the minimum wage requirements of New York, contact a knowledgeable New York wage and hour law attorney today to discuss your legal options.

Minimum Wage Requirements in New York

Although there is a federal wage law that dictates the minimum amount employers can pay their employees, some states have their own minimum wage requirements, and in states where the minimum wage rate is higher than the federal standard, which is $7.25 per hour, employers must comply with the state regulations. As a rule, an employer who is subject to more than one minimum wage law must follow the law that is most generous to the employee. As of December 31, 2016, the basic minimum wage requirement is $9.70 per hour in most of New York State, although there are different minimum wage requirements for Long Island, Westchester County, the fast food industry, and large and small employers in New York City.

In New York, the minimum wage rates are scheduled to increase every year on December 31, until they reach $15.00 per hour, or $10.00 per hour for “tipped” employees, for whom an employer may take a credit towards the minimum hourly rate, if the employee makes enough in tips. On and after December 31, 2015, a “tipped” employee is entitled to a wage of at least $7.50 per hour, and credit for tips shall not exceed $1.50 per hour, provided that the total amount the employee earns in tips plus wages equals or exceeds $9.00 per hour. In other words, the FSLA allows employers to pay tipped employees a lower minimum wage, as long as that wage plus their tips adds up to at least the full minimum wage requirement for each hour worked. The minimum wage law in New York does not apply to the following workers:

- Taxi drivers

- Babysitters

- Staff counselors in children’s camps

- Volunteers at recreational or amusement events that do not run longer than 8 days

- Outside salespersons

- Workers in a bona fide executive, professional or administrative capacity

- Volunteers or apprentices for charitable, educational or religious organizations

- Members of religious orders (priests, rabbis)

- Students and handicapped individuals working for religious or charitable organizations

- Employees of a summer camp operated by a religious or charitable organization if it operates less than three months each year

- Employees of federal, state or municipal governments or their subdivisions

- Employees of student or faculty associations

Minimum Wage Requirements for NY Farm Workers

There are special wage and hour law requirements for farm workers employed on farms in New York, where the total cash remuneration paid all persons employed on the farm exceeded $3,000 in the previous calendar year. According to the Minimum Wage Order for Farm Workers, all workers, with certain exceptions, are entitled to at least $9.70 per hour from their employer, which may include farm labor contractors, food processors or growers. Furthermore, employers of farm workers are entitled to deduct specified allowances from the minimum wage rate for meals and lodging, except for seasonal migrant workers.

Vacation, Holiday and Sick Leave in New York

Under the New York State Labor Law, vacations, holidays and/or sick leave fall under “time not worked,” and an employer is not required to pay for time not actually worked, unless the employer has established a policy to grant such pay. Should an employer decide to create a benefit policy including payment for sick time, vacations, personal leave and/or holidays, the employer is free to impose any conditions he or she chooses on the policy.

An Experienced New York Wage and Hour Law Attorney Can Help

Wage and hour law regulations in New York can be confusing, and workers who are unaware of their rights as an employee in New York may be vulnerable to wage and hour law violations, where their employer fails to pay them the wages they are entitled to. If your employer owes you wages, and you have asked him or her to pay you, you may want to consider contacting a reputable employment law attorney to discuss your possible compensation options. You may have grounds to file a wage and hour claim with the New York State Department of Labor, in order to recover unpaid wages, or to bring a court case to recover the wages you are owed.