New Mexico Wage and Hour Laws

Wage and hour laws in New Mexico set the basic standards for minimum wage, meal and rest breaks, what counts as time worked, and other wage and hour concerns affecting employees across the state. If you work in New Mexico, and you haven’t been paid minimum wage, or if your employer has failed to pay you for rest breaks that should be counted as compensable work hours, you may be entitled to financial compensation for your losses, which you can pursue by filing a wage and hour claim against your employer in court. Consult a skilled New Mexico employment law attorney as soon as possible to explore your possible compensation options.

New Mexico Minimum Wage Regulations

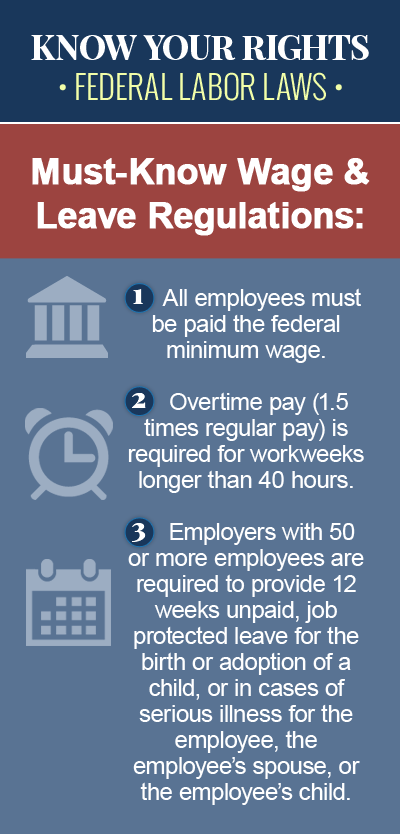

Minimum wage is the lowest hourly, daily or monthly wage that employers are legally permitted to pay employees, and the minimum wage requirement in New Mexico is $7.50, which means employers are required to pay nonexempt employees a minimum wage of $7.50 per hour. Although the federal minimum wage rate in the United States is currently $7.25 per hour, employers subject to more than one minimum wage law are required to follow the law that is most generous to the employee, which in this case is state law. Under the New Mexico Minimum Wage Act, the following workers are not considered “employees,” and are therefore not covered under the state minimum wage requirements:

- Foremen, superintendent and supervisors

- Employees working in domestic service in or about a private home

- Employees working for the federal government

- Administrative, executive or professional employees

- Volunteers working for educational, religious, charitable or nonprofit organizations

- Seasonal employees whose employer has obtained a valid certificate from the state’s labor commissioner

- Certain agricultural employees

- Registered apprentices

- Employees working for an ambulance service

In some cases, New Mexico employees who are not covered by the state minimum wage law may still be covered under the federal Fair Labor Standards Act (FLSA).

Minimum Wage for Tipped Employees in NM

Employees in New Mexico who customarily and regularly receive more than $30 per month in tips can be paid a lower rate of $2.13 per hour, so long as the tips they earn plus their hourly wage adds up to New Mexico’s minimum wage requirement. If it doesn’t, the employer is required to make up the difference. An employer in New Mexico who supplies food, housing or utilities to an employee engaged in agriculture work is permitted to deduct the reasonable cost of these items from the employee’s wages, even if the deduction brings the employee’s wages below the required minimum wage rate.

New Mexico Meal and Rest Breaks

Neither state law nor federal law requires employers in New Mexico to provide their employees with rest breaks or meal periods during the workday. However, when employers do offer short breaks, usually lasting between five and 20 minutes, federal law considers the breaks a compensable part of the workday, and they must be paid. Should an employer in New Mexico decide to provide employees with a meal period during the workday, typically lasting at least 30 minutes, this break is not considered part of the workday, and can be unpaid.

Contact a Knowledgeable NM Wage and Hour Law Attorney Today

The New Mexico Wage and Hour Bureau enforces minimum wage regulations in New Mexico, the payment of wages to employees, and overtime labor laws under the Minimum Wage Act, and any employee who has been the victim of a wage and hour law violation in New Mexico should contact an experienced lawyer as soon as possible for legal help. With a qualified New Mexico employment law attorney on your side, you can protect your legal rights and pursue the financial compensation you are entitled to. Keep in mind that there is a limit to the amount of time you have to pursue a wage and hour claim in New Mexico, and should the statute of limitations on your claim expire, you may no longer have the right to pursue a claim in court.