New Jersey Employment Law

The federal Fair Labor Standards Act (FLSA) and New Jersey law set the wage and hour standards employers in New Jersey must adhere to, including minimum wage requirements, overtime pay and other wage laws. There are also employment laws at the federal and state level that prohibit employers from sexually harassing employees, discriminating against employees because of their membership in a protected class, or retaliating against employees for exercising their rights, among other important labor laws. If you believe you have been the victim of employment discrimination, wrongful termination, or another labor law violation in New Jersey, contact a knowledgeable employment law attorney today to discuss your legal options.

Wage and Hour Laws

Federal and state labor laws in New Jersey set the basic standards for employee pay and time worked, and in the state of NJ, the current minimum wage requirement is $8.44, which means all nonexempt employees in New Jersey are entitled to a rate of at least $8.44 per hour, with minimum wage increases expected in the future based on changes in the Consumer Price Index. Employers must also pay nonexempt employees in New Jersey a rate of one-and-one-half-times their regular rate of pay for every hour worked over 40 in a single workweek. Employees who are paid less than minimum wage, or who are owed back pay for regular or overtime hours, may have a wage and hour claim against their employer.

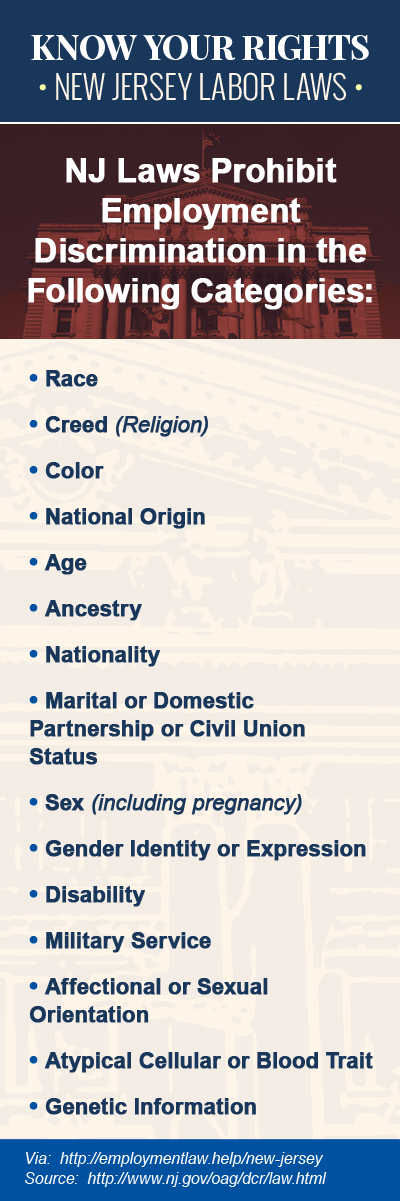

Workplace Discrimination

State and federal antidiscrimination laws make it illegal for employers in New Jersey to make employment decisions on the basis of a protected characteristic, such as age, sex, national origin, race or disability. These laws prevent employers from intentionally discriminating against members of a protected class, or making job-related decisions that have a disproportionate adverse impact on members of a protected class, i.e. setting a minimum height requirement for employment applicants, which would exclude from consideration a disproportionate number of women and people of certain ancestries or national origins.

Sexual Harassment

There are two main types of workplace discrimination in New Jersey: diversity discrimination, or differential treatment that reflects a discriminatory bias in regards to an employee’s race, national origin or ancestry, and sexual harassment, or unwelcome sexual advances or requests for sexual favors by an employer, supervisor or coworker. Whether it comes in the form of “quid pro quo” harassment, in which an employer suggests that submission to sexual demands is a condition of employment, or “hostile work environment harassment,” in which the harassment is severe enough that the working environment becomes abusive or hostile, sexual harassment is against the law in New Jersey.

Wrongful Termination

Like many other states, New Jersey is an at-will employment state, which means employers in NJ can terminate a working relationship (fire an employee) at any time and for any reason, or even for no reason at all. However, there are important exceptions to the at-will employment rule in New Jersey, which make it illegal for employers to fire an employee on the basis of a protected characteristic, such as race, sex, religion, color or pregnancy. Wrongful termination laws in New Jersey also prohibit employers from retaliating against an employee for asserting his rights, i.e. firing an employee who files a discrimination complaint or who takes time off work for certain personal responsibilities or civic obligations.

SSI/SSDI Disability Benefits

Under federal law, individuals in New Jersey who are unable to work because of a severe physical or mental disability may qualify for monthly benefits in the form of Supplemental Security Income (SSI) or Social Security Disability Insurance (SSDI). SSDI benefits are available to disabled individuals who have worked long enough in the past, paid Social Security taxes, and meet the Social Security Administration’s definition of disability, while SSI benefits are based on financial need, and are available to disabled, blind or elderly individuals regardless of their prior work history. In some cases, the state of New Jersey may pay an additional monthly payment to individuals who qualify for SSI benefits, to supplement the federal payment.

Federal Employment Law Links