Utah Wage and Hour Laws

The federal Fair Labor Standards Act (FLSA) and state wage and hour laws set the basic standards for employee pay and time worked, covering such issues as minimum wage, tips, meal and rest breaks, and other wage and hour concerns affecting workers in Utah. These laws also provide certain civil remedies for Utah employees who have been treated in a way that violates state or federal wage and hour laws. If you believe you have been the victim of a wage and hour law violation in Utah, contact a knowledgeable Utah employment law attorney today for legal help. You may have grounds to file a wage and hour claim against your employer, in order to pursue financial compensation for your losses.

Minimum Wage Requirement in Utah

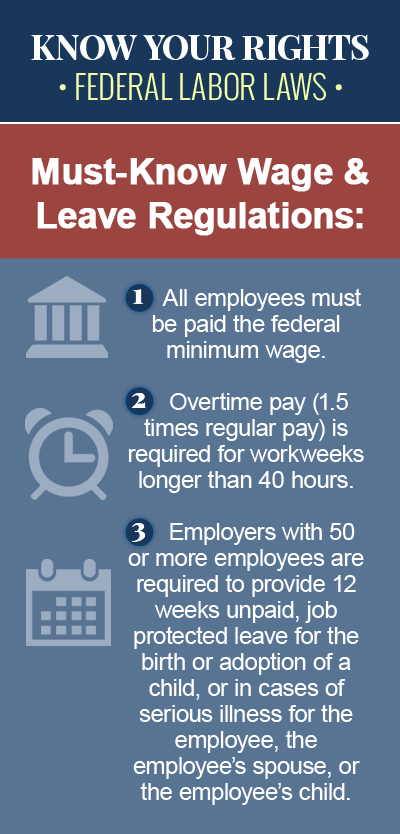

The federal Fair Labor Standards Act (FLSA) has provisions in place that protect the rights of employees in terms of wages, setting the basic standards for time worked and minimum wage, although many states have their own requirements in place for the payment of hourly wages. And according to federal law, employers subject to more than one minimum wage law are required to follow the law that is most generous to the employee. However, because there is no state minimum wage requirement in Utah, employers are only required to comply with the federal minimum wage law, which states that nonexempt employees must be paid at least $7.25 per hour. Together, the FLSA and Utah state law exempts certain types of employees from its minimum wage standards, including the following:

- Executive employees

- Administrative employees

- Professional employees (creative, learned and teaching professionals)

- Outside salespersons

- Computer employees (computer systems analysts, computer programmers, software engineers)

- Employees who are members of their employer’s immediate family

- Agricultural employees

- Employees of seasonal amusement establishments

- Seasonal employees of nonprofit camping, religious, recreational, educational or charitable organizations or programs

Utah Minimum Wage for “Tipped” Employees

As in many other states, “tipped” employees in Utah, or employees who customarily and regularly receive tips of at least $30 per month during the course of their employment, can be paid a lower minimum wage rate of $2.13 per hour, so long as the tips they earn plus their hourly wage rate equals the federal requirement of $7.25 per hour. If the employee’s tips plus the so-called “service” wage does not add up to the federal minimum wage rate, the employer is required to make up the difference.

Utah Meal Periods and Rest Breaks

There are no laws in Utah requiring employers to provide employees with regular meal periods of rest breaks. However, most employers, in the interest of good employee relations, will establish a company policy regarding rest breaks and meal periods. Should an employer in Utah provide his or her employees with a meal period during which they are required to continue working, the period must be paid. Generally, employees are also entitled to be paid for any short breaks between five and 20 minutes that the employer provides. In Utah, minors under the age of 18 are entitled to a meal period of at least 30 minutes to be taken no later than five hours from the beginning of their shift, as well as a ten-minute rest break for every three-hour period they work.

An Experienced Utah Wage and Hour Law Attorney Can Help

The state and federal laws protecting the rights of employees in Utah are strict, and any employee who has been the victim of a wage and hour law violation in Utah may be entitled to financial compensation for lost wages, back pay, liquidated damages and other penalties. If your Utah employer has failed to pay you minimum wage, or if you were required to work during a meal period for which you were not paid, you may have grounds to file a wage and hour claim against your employer. Consult a knowledgeable Utah employment law attorney as soon as possible to discuss your legal rights.