Utah Employment Law

Utah employment law, also known as labor law, is an area of the law that governs nearly every aspect of the employee/employer relationship in Utah, establishing strict rules that are designed to keep employees safe and to ensure they are treated fairly in the workplace. In addition to prohibiting workplace discrimination against members of a protected class, Utah employment law also sets the basic standards for minimum wage, protects the rights of employees who are owed back pay by their employers, and regulates COBRA continuation coverage and disability benefits. If you believe you have been the victim of an employment law violation in Utah, contact a knowledgeable employment law attorney today to discuss your legal rights.

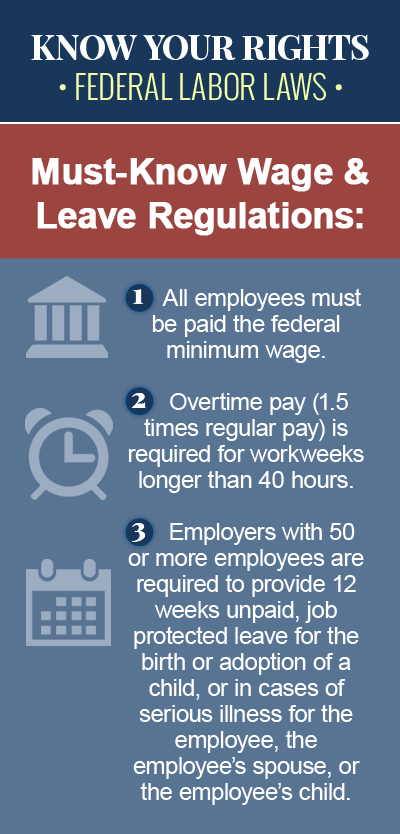

Wage and Hour Laws

There is no state minimum wage requirement in Utah, which means employers in Utah follow federal law in respect to minimum wage, paying nonexempt employees a minimum rate of $7.25 per hour. In Utah, “tipped” employees, or employees who customarily and regularly receive tips equaling at least $30 per month, can be paid an hourly rate of $2.13 per hour, so long as their hourly rate plus the tips they earn adds up to the federal minimum wage rate. Utah also does not have its own laws regulating meal periods or rest breaks, though employees in the state are typically paid for any short breaks between five and 20 minutes that the employer does provide, as well as for any meal periods during which they are required to continue working.

Unpaid Wages and Overtime

Because Utah does not have its own laws in place regulating the payment of overtime wages, federal overtime laws apply to employers across the state. According to the federal Fair Labor Standards Act (FLSA), nonexempt employees in Utah who work more than 40 hours in a given workweek are entitled to a premium hourly rate of one-and-one-half-times their regular rate of pay for all hours worked over 40. Federal law also protects the rights of employees who have not been paid the wages they are due, and provides civil remedies for employees who are owed back pay by their employers, for regular or overtime hours worked.

Workplace Discrimination

Workplace discrimination describes any employment decision made by an employer or supervisor that has a disproportionate adverse impact on members of a protected class, or a group of people with a shared characteristic that is protected by law. In Utah, it is considered unlawful for an employer to discriminate against an employee on the basis of a protected characteristic, such as race, color, sex, age, disability, religion, genetic information or national origin. It is also against the law for an employer to retaliate against an employee for exercising his rights by filing a workers’ compensation claim, opposing an unlawful discriminatory practice, or taking time off work to fulfill certain personal or civic obligations.

Wrongful Termination

A type of employment discrimination, wrongful termination occurs when an employer in Utah fires an employee for reasons that are considered unlawful, i.e. in retaliation for exercising his rights, in breach of an employment contract promising job security, or in violation of state or federal antidiscrimination laws. Employees who believe their termination from employment was unlawful may have a claim for wrongful termination against their employer, which an experienced attorney can help them pursue in court.

COBRA Continuation Coverage

The Consolidated Omnibus Budget Reconciliation Act (COBRA) is a federal law that allows employees and certain members of their family to extend their group healthcare coverage for a limited period of time, in certain specified circumstances where they would otherwise lose their health benefits, such as job loss, a reduction in work hours, or death of the covered employee. Federal COBRA law only applies to employers with 20 or more employees, but Utah has a state “mini-COBRA” law in place that provides a similar continuation of healthcare coverage to employees who work for small businesses.

SSI/SSDI Disability Benefits

Supplemental Security Income (SSI) and Social Security Disability Insurance (SSDI) are two federally-funded programs administered by the Social Security Administration (SSA) that pay monthly benefits to individuals who are unable to work because of a severe physical or mental disability. While SSDI benefits are only available to disabled individuals who have worked long enough and recently enough to be considered “insured,” the SSI program is based on financial need, and makes monthly cash payments to disabled, aged or blind individuals and children with little income and resources, for basic needs like food, shelter and clothing.

To learn more about Federal US employment laws, browse the following topics: