Massachusetts Wage and Hour Laws

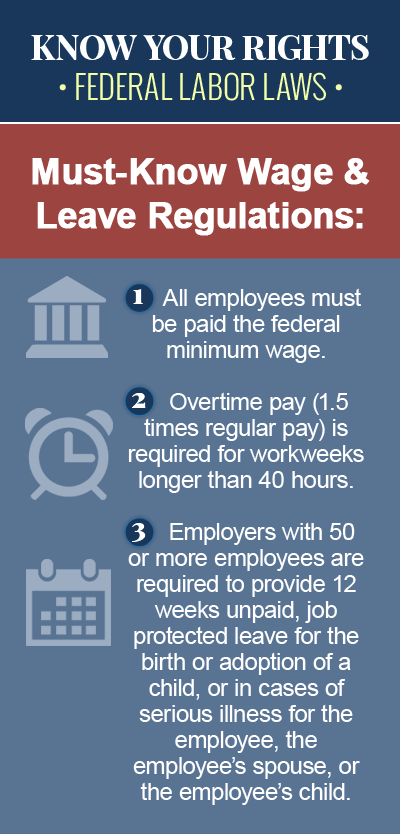

Wage and hour laws set the basic standards for employee pay, time worked, minimum wage and the method and manner of payment of wages, and while the federal wage and hour law, known as the Fair Labor Standards Act (FLSA), creates some basic wage and hour protections for employees throughout the United States, most states also have their own wage and hour laws, including Massachusetts. Massachusetts wage and hour laws dictate the minimum wage employees must be paid, whether they are regular or “service” employees, and what rest breaks or meal periods they are entitled to during the workday, among other wage and hour concerns. If you believe you have been the victim of a wage and hour law violation in Massachusetts, consult an experienced Massachusetts employment law attorney as soon as possible to discuss your legal rights.

Minimum Wage Requirements in Massachusetts

Effective January 1, 2017, the minimum wage requirement in Massachusetts is $11.00 per hour, which means all nonexempt employees in Massachusetts must be paid an hourly rate of at least $11.00. Although the federal minimum wage requirement is only $7.25, federal law requires employers subject to more than one minimum wage law to follow the law that is most generous to the employee, which in this case is the state requirement. Under Massachusetts law, all workers are presumed to be employees, and the minimum wage requirement applies to all employees, except the following:

- Agricultural workers (the minimum wage for agricultural workers is $8.00 per hour)

- Members of a religious order

- Outside salespeople

- Workers being trained in certain educational, nonprofit, or religious organizations

The Massachusetts Minimum Fair Wage Law does not differentiate between part-time or full-time employment, and both types of employees are entitled to the same hourly minimum wage rate.

Rules for “Tipped” Employees in Massachusetts

Different wage and hour rules apply to “tipped” employees in Massachusetts, or workers who earn an hourly service rate, plus tips, and Massachusetts wage and hour laws permit employers to pay these workers an hourly “service rate,” which is $3.75 per hour, so long as the worker earns more than $20 a month in tips, and the tips the worker earns plus the service rate adds up to at least the minimum wage for every hour worked. If the worker’s tips plus their hourly service rate adds up to less than the minimum wage requirement in Massachusetts, the employer is required to pay the difference.

Massachusetts Meal Periods and Rest Breaks

In Massachusetts, most employees who work more than six hours in a single shift are entitled to a 30-minute meal period, during which they are free from all work duties, and are free to leave the workplace. If the employer requires the employee to stay at the workplace or continue working during the meal period, the employee must be paid for that time. Otherwise, the meal break can be unpaid. Although many Massachusetts employers provide employees with one or two paid rest breaks during the work day, in addition to time for lunch, they are not required by law to do so.

File a Minimum Wage Claim in Massachusetts

There are strict state and federal laws in place in Massachusetts that protect the rights of employees in the workplace, including their right to a minimum wage rate of $11.00 per hour, and their right to a 30-minute meal period during which they are free from all work duties. If your employer has failed to pay you minimum wage, or if you were not paid for a meal period during which you were required to work, you may have grounds to file a claim against your employer for damages. Contact a knowledgeable Massachusetts wage claim attorney today to explore your options for legal resource.