Massachusetts Unpaid Wages and Overtime

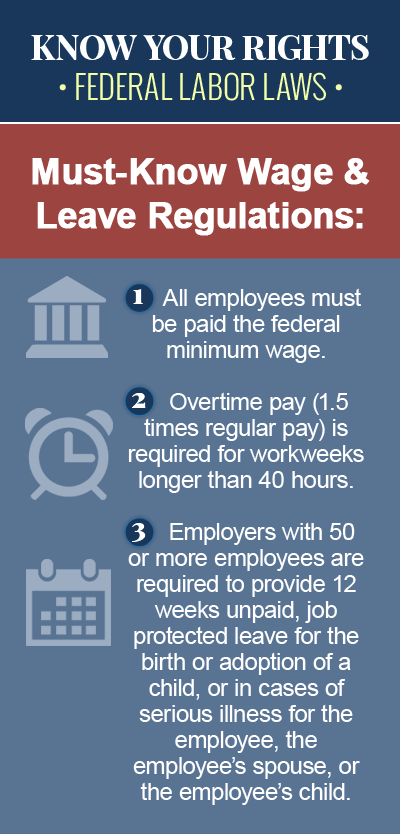

State and federal labor laws protect the rights of employees in Massachusetts and across the United States, ensuring that they are paid in full the wages they have earned, and that these wages are paid on time. Unfortunately, not all employers abide by the law, and failing to pay the overtime premium is one of the most common wage violations on the part of employers. If your Massachusetts employer has failed to pay you the wages you are due for regular or overtime hours worked, you may be entitled to financial compensation for your unpaid wages, plus penalties. Consult a reputable Massachusetts unpaid wages attorney today to explore your legal options.

Massachusetts Overtime Requirements

Under Massachusetts law, employees who work more than 40 hours in a given workweek must be paid overtime wages in the amount of at least one-and-one-half-times their regular rate of pay for each hour worked over 40. However, state law includes some exceptions for certain jobs and workplaces that are exempt from the overtime requirement, including the following job categories:

- Outside salespeople or outside buyers

- Golf caddies, newspaper deliverers, or child actors or performers

- Janitors or caretakers of residential properties

- Executive, administrative or professional employees

- Fishermen

- Switchboard operators

- Seamen

- Workers in a hotel, motel, motor court or similar establishment

- Workers in a restaurant

- Workers in a gasoline station

- Workers in a nonprofit school or college

- Workers in a summer camp operated by a nonprofit charitable corporation

- Workers in a hospital, sanatorium, convalescent or nursing home or rest home for the aged

- Laborers engaged in agriculture and farming on a farm

- Workers in an amusement park that operates only part of the year

In general, the Minimum Fair Wage Law in Massachusetts does not require extra pay for hours worked during the night, on weekends or during holidays, although the Massachusetts Blue Laws, enforced by the Attorney General’s Fair Labor Division, require some retailers in the state to pay a premium rate to employees who work on Sundays and certain holidays. The state of Massachusetts does not require the payment of overtime wages for hours worked over eight in a single workday.

Unpaid Wages in Massachusetts

According to labor law, an employee’s “pay” includes payment for all hours worked, including tips, promised holiday pay, earned vacation pay, and earned commissions, and state law in Massachusetts dictates when, what, and how employees must be paid the wages they are owed. Under Massachusetts law, hourly employees must be paid every week or every other week, and the deadline for payment of wages is six or seven days after the end of the pay period, depending on how many days the employee worked during one calendar week. There are also regulations in place dictating when Massachusetts employees who quit or are fired or laid off must be paid their final wages. According to the law, employees who quit must be paid their final wages on the next regular payday or by the first Saturday after they quit, if there is no regular payday. Employees who are fired or laid off must be paid their final wages on their last day of work.

Contact a Massachusetts Unpaid Wages Attorney Today

Employees who are owed back pay by their employers for regular or overtime hours worked may have grounds to file an unpaid wages claim in Massachusetts, in order to recover the wages they are due, plus penalties. In fact, Massachusetts law allows employees to request a penalty equal to three times the amount their employer should have paid them, in instances where the employer violates state minimum wage or overtime laws. If you believe you have been the victim of a wage and hour law violation in Massachusetts, contact an experienced employment law attorney today to discuss the possibility of filing an unpaid wages claim against your employer.