Massachusetts Employment Law

Employment law is a broad area of the law, much of which is regulated by the federal government, but there are laws at the state level too, that provide further protections for Massachusetts employees. In Massachusetts, for example, while the federal minimum wage rate is only $7.25, state wage and hour laws require that nonexempt employees be paid an hourly rate of at least $11.00. State and federal employment laws also provide civil remedies for employees who believe their employer has taken illegal action against them, either by discriminating against them in making certain employment decisions, paying them less than minimum wage, or otherwise treating them unfairly at work. If you believe you have been the victim of an employment law violation in Massachusetts, contact a knowledgeable attorney as soon as possible to discuss your legal options.

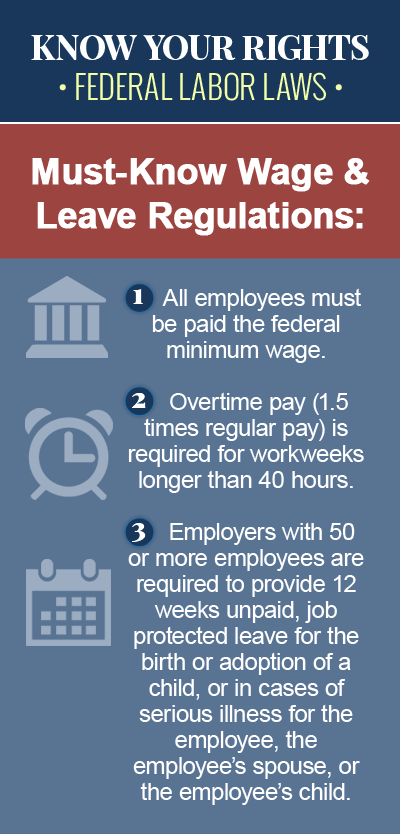

Wage and Hour Laws

Massachusetts wage and hour laws set the basic standards for minimum wage, hours worked, and other wage and hour concerns, and according to state law, the minimum wage requirement in Massachusetts is $11.00 per hour, compared to the federal minimum wage rate of $7.25. In Massachusetts, employees who work more than six hours in a single shift are entitled to an unpaid, 30-minute meal period, during which they are free from all work duties and are free to leave the workplace, and while employers are not required to provide employees with paid rest breaks during the day, many do so anyway.

Unpaid Wages and Overtime

Most employees in Massachusetts who work more than 40 hours in given workweek are entitled to overtime wages in the amount of one-and-one-half-times their regular rate of pay, with some exceptions. There is no overtime requirement in Massachusetts for employees who work more than eight hours in a single workday. Under Massachusetts law, an employee who is owed back pay for regular or overtime hours worked may have a claim for unpaid wages against his or her employer.

Workplace Discrimination

Workplace discrimination occurs when an employer makes an employment decision that has a disproportionate adverse impact on members of a “protected class,” or a group of people with a shared personal characteristic that is protected by law. Discrimination can occur in any part of the employee/employer relationship, including hiring, firing (wrongful termination), pay, promotions, benefits and transfers, and an employment decision may be considered unlawful if it is based on the employee’s race, sex, age, color, race, citizenship status, disability, or another protected characteristic.

Wrongful Termination

Wrongful termination, a type of workplace discrimination, occurs when an employer fires an employee for reasons that violate an employment contract, public policy, or state or federal antidiscrimination laws. Under wrongful termination laws, employers in Massachusetts are prohibited from firing an employee because of his membership in a protected class, if the employee has a written, oral or implied employment contract promising job security, or because the employee exercised his rights by opposing discrimination in the workplace, filing a workers’ compensation claim, or reporting illegal activity on the part of the employer.

COBRA Continuation Coverage

COBRA continuation coverage is a federal law that gives employees and members of their family the right to extend their group health plan for a certain period of time, in specific situations where their health benefits would otherwise be terminated. These so-called “qualifying events” may include job loss, reduced work hours, death of the covered employee, divorce or legal separation from the covered employee, or loss of dependent status under the health plan’s provisions. While federal COBRA laws only apply to employers with 20 or more employees, there is also a state law in Massachusetts that provides a similar continuation of healthcare coverage for employees who work for businesses with fewer than 20 employees.

SSI/SSDI Disability Benefits

Individuals in Massachusetts who are unable to work because of a severe physical or mental disability may be entitled to monthly benefits from the Supplemental Security Income (SSI) or Social Security Disability Insurance (SSDI) programs, both of which are administered by the federal government. SSDI benefits are based on “work credits,” or how long the individual worked and paid Social Security taxes before becoming disabled, while SSI provides cash payments to aged, blind or disabled individuals based on financial need.

To learn more about Federal US employment laws, browse the following topics: