Florida Wage and Hour Laws

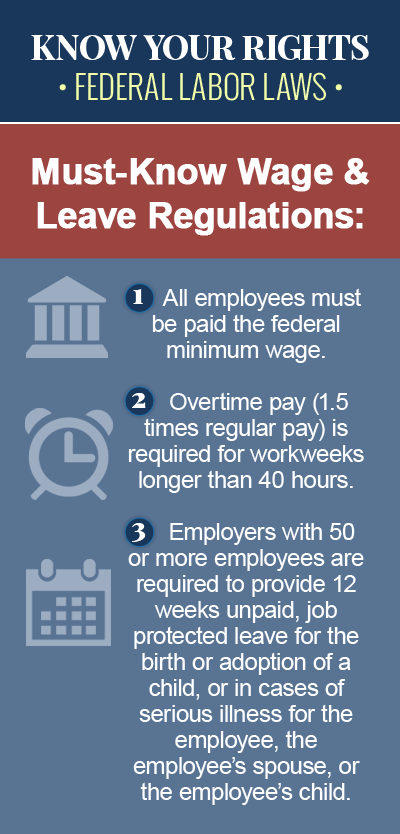

The Fair Labor Standards Act (FLSA) and state laws set the basic standards for employee wages, time worked, and other wage and hour considerations in Florida, including minimum wage rates and meal and rest breaks, and provides civil remedies to victims of wage and hour law violations on the part of their employers. If your employer has failed to pay you the minimum wage rate in Florida, or if you are owed back pay for meal breaks or rest periods, consult a reputable wage and hour lawyer in Florida for legal help. You may be entitled to financial compensation for lost wages and other damages, which you can pursue by filing a labor law claim against your employer.

Minimum Wage Rates in Florida

Under Florida law, employers are required to provide employees with a “minimum wage” for work performed. Effective January 1, 2017, the minimum wage rate in Florida is $8.10 per hour, which means nonexempt employees in Florida are entitled to an hourly wage of at least $8.10, although state law requires the Florida Department of Economic Opportunity to calculate a minimum wage rate each year, based on the percentage increase in the federal Consumer Price Index. Compared to the $8.10 minimum wage rate in Florida, the federal minimum wage requirement is only $7.25, but federal law dictates that in states like Florida, where employers are subject to more than one minimum wage requirement, they must follow the law that is most generous to the employee.

There are certain exceptions to the Fair Labor Standards Act though, and Florida workers who do not meet the definition of a “covered employee” under federal law do not enjoy the minimum wage protections the FLSA affords. The following types of workers are not considered covered employees by the Fair Labor Standards Act:

- Independent contractors

- Farmworkers employed on small farms

- Babysitters

- Executive, administrative, professional and outside sales employees that are paid a salary

Minimum Wage for Tipped Employees in Florida

Under Florida minimum wage laws, employers are permitted to pay “tipped” employees a lower hourly rate (currently $5.08 per hour), so long as the employees are paid the regular minimum wage rate of $8.10 when the tipped wage rate is combined with the tips they receive. Tipped employees who are not paid the minimum wage may have a wage and hour claim against their employer.

Meal Breaks and Rest Periods for FL Employees

Although Florida does not have any laws requiring an employer to provide a meal break to employee 18 years of age or older, Florida labor laws do require employers to grant a meal break of at least 30 minutes to employees under the age of 18 who work for more than four hours consecutively. If an employer chooses to provide employees with a rest period lasting less than 20 minutes, it must be paid. Meal or lunch breaks in Florida (usually lasting 30 minutes or more), do not need to be paid, so long as the employee is free to do as he wishes during the break, i.e. he isn’t required to continue performing work duties.

An Experienced FL Wage and Hour Law Attorney Can Help

While the majority of Florida employers treat their employees fairly and pay them in accordance with the law, there are some employers who take advantage of their employees, subjecting them to unfair treatment at work and paying them a wage that is lower than state or federal law requires. If you believe you have been the victim of a wage and hour violation in Florida, you may have grounds to bring a civil suit against your employer for lost wages and other damages. Contact an experienced Florida labor law attorney today to discuss your legal options. With a knowledgeable lawyer on your side, you can ensure that your rights are protected, and improve your chances of a receiving a favorable outcome in your case.