Florida Unpaid Wages and Overtime

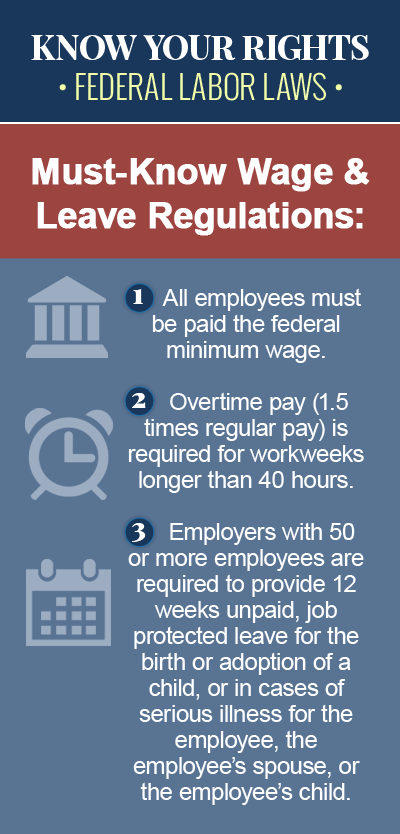

The Fair Labor Standards Act (FLSA) is a federal law that sets the basic standards for minimum wage, overtime and other employment law requirements, but many states have enacted their own labor laws dictating the standards employers must comply with in regards to nearly every aspect of the employee/employer relationship. If you have been paid less than the state minimum wage requirement in Florida, or if you are owed back pay for regular hours worked or overtime hours, contact a knowledgeable Florida employment law attorney today for legal help. You may have grounds to file an unpaid wages claim against your employer, to recover the wages you are owed and other related damages.

Overtime Pay in Florida

The state of Florida does not have any labor laws governing the payment of overtime wages to employees, which means federal overtime laws apply. According to the federal Fair Labor Standards Act (FLSA), there are no limits to the number of hours an employee can be asked to work in a given workday or workweek. However, unless an employee is otherwise exempt from the FLSA’s overtime requirements, employers are required to pay employees an overtime rate of one-and-one-half-times their regular rate of pay for all hours worked over 40 in a given workweek. Federal labor law also dictates that, as long as a nonexempt employee does not work more than 40 hours in a workweek, an employer is not required to pay overtime wages, even if the employee works more than eight hours in one day, or works on a Saturday, Sunday or holiday.

Filing a Claim for Unpaid Wages

Under Florida law, there are no requirements as far as when or how frequently employers must pay employees their wages, nor are there any state laws requiring an employer to pay an employee wages he is due when involved in a wage dispute with the employee. However, federal and state law gives employees in Florida the right to collect the wages they are owed, plus penalties, which they can do by filing an unpaid wages claim against their employer. In Florida, if an employer violates the state minimum wage law and the employee wins his administrative claim or lawsuit, the employee is entitled to his unpaid wages plus liquidated damages in an amount equal to the unpaid wages award.

If your employer fails to pay you all of the wages you are owed for regular or overtime hours worked, you can file a claim with the federal Department of Labor or file a lawsuit against your employer in court. To calculate the wages you are owed for an unpaid wages claim in Florida, take the difference between what you were actually paid per hour and what you should have been paid per hour, and multiple that amount by the total number of hours you worked. Tipped employees in Florida who don’t earn enough in tips to equal at least the state minimum wage requirement when their hourly rate is combined with the tips they received may also have an unpaid wages claim against their employer.

Contact an Experienced Employment Law Attorney Today

Under Florida employment law, an employee has four years to file an unpaid wages lawsuit against his employer, or five years, if the wage and hour law violation was willful. If you plan to move forward with an unpaid wages claim against your employer, either with the Department of Labor or in court, your first course of action should be to hire an experience Florida wage and hour lawyer to discuss your legal options. A knowledgeable attorney can ensure that you understand your legal rights as an employee owed unpaid wages, and can also tell you if you have any other claims against your employer, such as a breach of contract claim.