Colorado Unpaid Wages and Overtime

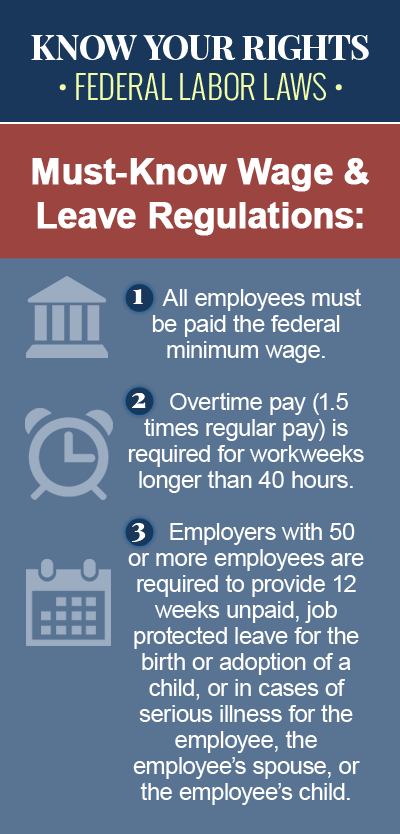

There are state and federal laws in effect in Colorado that entitle employees covered by the provisions of the Colorado state minimum wage law or the federal Fair Labor Standards Act (FLSA) to a premium wage rate for overtime hours worked, and Colorado employers subject to more than one overtime law are required to follow the law that is most generous to the employee. These wage and hour laws also provide civil remedies to employees who are owed back pay by their employers, either for overtime hours that were not paid as such, or for final wages upon termination of the employee/employer relationship. If your employer has failed to pay you the wages you are entitled to under state or federal law, you may have grounds to file a claim against your employer in civil court. Contact an experienced Colorado employment law attorney today for legal help.

Colorado Overtime Requirements

Employees in Colorado who are covered by the Colorado Minimum Wage Order Number 33, a state law addressing minimum wage and overtime pay, may, in some cases, qualify for a premium wage rate for overtime hours. Under state law, Colorado employers are required to pay a premium wage of one-and-one-half-times their regular pay of pay to any nonexempt employee who works: more than 40 hours in a single workweek, more than 12 hours in a single workday, or more than 12 consecutive hours without regard to the starting and ending time of the workday, whichever calculation results in the greatest payment of wages. There are certain exemptions to the Colorado overtime wage requirement, and the following employees are considered “exempt” from the overtime provisions of the Colorado Minimum Wage Order Number 33:

- Salespersons, parts-persons and mechanics employed by automobile, truck or farm implement dealers

- Sales employees of retail or service industries paid on a commission basis

- Employees of the ski industry performing duties directly related to ski area operations for downhill skiing or snow boarding

- Employees of the medical transportation industry who are scheduled to work 24-hour shifts are exempt from the 12-hour overtime requirement, but not the 40-hour overtime requirement

Unpaid Wage Claims in Colorado

Under the Colorado Wage Act, also known as the Colorado Wage Law, the Colorado Wage Claim Act or the Colorado Wage Protection Act, employers in the state of Colorado are required to pay their employees their earned wages in a timely manner. When the employee/employer relationship is terminated by the employer, i.e. the employee is fired or laid off, final wages are due immediately, except in the following instances: the employer’s accounting unit is not regularly scheduled to be operational, in which case the wages are due no later than six hours after the start of the accounting unit’s next regularly scheduled workday; the accounting unit is located off the work site, in which case the wages are due no later than 24 hours after the start of the accounting unit’s next regularly scheduled workday. When an employee voluntarily quits or resigns, final wages are due on the next regular payday.

Contact an Experienced Colorado Employment Law Attorney Today

It is against the law for an employer to pay an employee covered by the Colorado Wage Act less than the legal minimum wage, and to do so is considered a misdemeanor offense in the state of Colorado. A nonexempt Colorado employee who receives less than the legal minimum wage they are entitled to for regular or overtime hours worked may be able to recover the wages they are owed, plus reasonable attorney fees and court costs, which they can do by hiring an unpaid wage claim attorney and filing a lawsuit in civil court. Consult a knowledgeable unpaid wage claim lawyer as soon as possible, if you are owed back pay by your Colorado employer.