Colorado Wage and Hour Laws

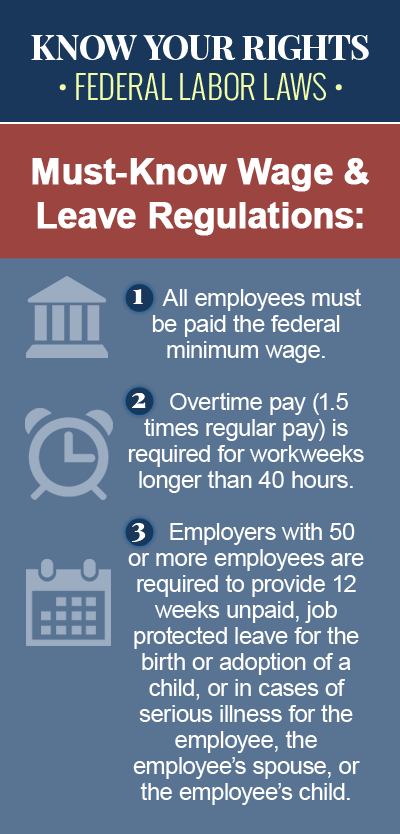

There are federal laws in place that set the basic standards for minimum wage, meal and rest breaks, and other wage and hour concerns affecting employees and employers across the country, but the state of Colorado has its own wage and hour laws in place, which provide further protections for Colorado employees. If you believe you have been the victim of a wage and hour law violation in Colorado, such as being paid less than the legal minimum wage rate, contact a knowledgeable Colorado employment law attorney today to discuss your legal options. You may have grounds to file a wage and hour claim against your employer in civil court, in order to pursue the financial compensation you deserve for your unpaid wages and other losses.

Colorado Minimum Wage Requirement

Per the Colorado Minimum Wage Order Number 33, the minimum wage requirement in the state of Colorado is $9.30, effective January 1, 2017. This means that Colorado employees covered by the minimum wage provisions of the Colorado Minimum Wage Order or the federal Fair Labor Standards Act (FLSA) are entitled to a minimum wage rate of $9.30 per hour. The Colorado Minimum Wage Order Number 33 regulates wages, hours, working conditions and other requirements for certain employees and employers for work performed in the following industries: food and beverage, retail and service, health and medical, and commercial support service. There are some employees and occupations that are exempt from the provisions of Minimum Wage Order Number 33, including:

- Administrative, executive/supervisor and professional employees

- Outside sales employees

- Elected officials and members of their staff

- Casual babysitters

- Property managers

- Taxi cab drivers

- Students employed by sororities, fraternities, college clubs or dormitories

- Students employed in a work experience study program

- Domestic employees employed by households or family members to perform duties in private residences

- Bona fide volunteers

Although the federal minimum wage requirement is only $7.25 per hour, employers subject to more than one minimum wage law are required to follow the law that is most generous to the employee, which, in this case, is state law. Colorado’s minimum wage requirement is scheduled to increase annually by $.90 on January 1 of every year, until it reaches $12 per hour, effective January 1, 2020. Thereafter, the minimum wage rate in Colorado will be adjusted annually for cost of living increases, based on changes in the Consumer Price Index.

Minimum Wage for Tipped Employees

In Colorado, employers are permitted to pay “tipped” employees, or those employees who customarily and regularly receive more than $30 per month in tips, a service minimum wage of $6.28, so long as their hourly wage rate plus tips equals the state minimum wage requirement for each hour worked. If it doesn’t, the employer is required to make up the difference in cash wages. Like the Colorado minimum wage requirement, the “tipped” minimum wage rate in Colorado is scheduled to increase by $0.90 increments on January 1 of every year, until it reaches $8.98 per hour, effective January 1, 2020.

Meal Periods and Rest Breaks in Colorado

Under Colorado wage and hour law, employees scheduled to work for five consecutive hours in a shift are entitled to an uninterrupted and “duty free” meal period lasting at least 30 minutes. During this time, the employee must be relieved of all work duties, or, in instances where the nature of the business activity makes an uninterrupted meal period impractical or impossible, the employee is permitted to consume an “on-duty” meal while performing his or her work duties. As for rest periods, employees in Colorado are entitled to a paid, ten-minute rest period for every four hours worked during the workday.

An Experienced Colorado Wage and Hour Law Attorney Can Help

If your employer has paid you less than the minimum wage rate required by law, or if you haven’t been paid for a meal period or rest break during the workday, you may be entitled to financial compensation for your losses, which you can pursue by filing an unpaid wages claim against your employer. Consult an experienced Colorado wage and hour law attorney as soon as possible to discuss your options for legal recourse.