Colorado Employment Law

Employment law, also known as labor law, is an important area of the law that sets the rights and duties of employers and employees across the country, establishing minimum wage and overtime requirements for hourly employees, and ensuring that all employees are treated fairly at work, free from unlawful discriminatory treatment in any stage of the employment relationship, among other labor law concerns. And while federal law establishes a baseline for minimum wage and other employment issues affecting workers across the country, states may set higher standards than those required by federal law. If you believe you have been the victim of a labor law violation in Colorado, contact a knowledgeable Colorado employment law attorney today to discuss your options for legal recourse.

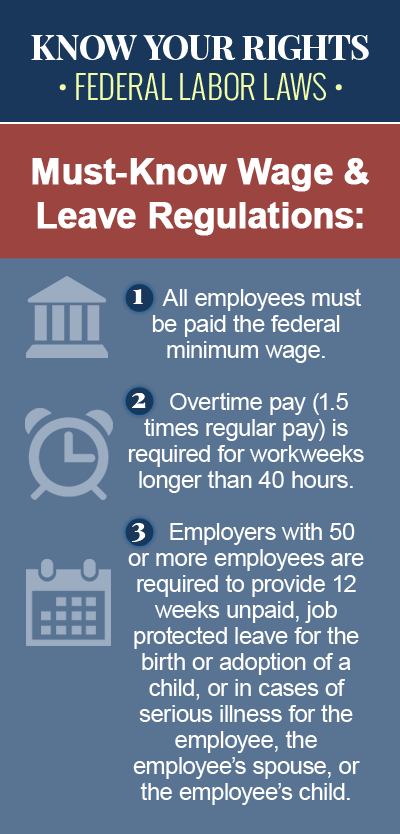

Wage and Hour Laws

Colorado wage and hour laws set the basic standards for time worked, minimum wage, meal and rest breaks, and other labor issues for workers in Colorado. Under Colorado law, the minimum wage requirement for nonexempt employees is $9.30, which means that Colorado employees covered by the minimum wage provisions of the federal Fair Labor Standards Act (FLSA) or the Colorado Minimum Wage Order are entitled to a minimum wage rate of $9.30 per hour, even though the federal minimum wage requirement is only $7.25. Colorado employees are also entitled to a paid, 10-minute rest break for every four hours worked in a single workday, and those scheduled to work for five consecutive hours in a shift are entitled to a 30-minute meal period, which can be unpaid.

Unpaid Wages and Overtime

Employers in Colorado are required to pay a premium wage of one-and-one-half-times the regular rate of pay to nonexempt employees who work overtime, which includes working: more than 40 hours in a single workweek, more than 12 hours in a single workday, or more than 12 consecutive hours without regard to the starting and ending time of the workday. Employees who are owed back pay by their employer for regular or overtime hours, or those who haven’t been paid their final wages following termination of the employment relationship, may have grounds to bring an unpaid wages claim against their employer.

Workplace Discrimination

Workplace discrimination can take place in any part of the employment relationship, from hiring to pay to discipline to firing (wrongful termination), and employees or job applicants who believe they have been the victim of employment discrimination in Colorado may be able to pursue a discrimination claim against their employer in court. The most common type of workplace discrimination occurs when an employer makes an employment decision that has a disproportionate adverse impact on members of a protected class – a group of people with a shared personal characteristic that is protected by law, i.e. race, color, religion or sex.

Wrongful Termination

Wrongful termination is a type of employment discrimination, describing a situation in which an employee is fired for unlawful reasons that violate public policy, an employment contract, or state or federal antidiscrimination laws. Although employment in Colorado is “at will,” meaning an employer can fire an employee at any time and for any reason, or for no reason at all, it is against the law for an employer to discriminate in terminating an employee. Examples of wrongful termination include firing an employee based on his membership in a protected class, or in retaliation for engaging in a protected activity, such as filing a workers’ compensation claim or opposing discriminatory practices in the workplace.

COBRA Continuation Coverage

The federal Consolidated Omnibus Budget Reconciliation Act (COBRA) was passed in 1986, giving former employees, their spouses and dependent children the right to choose to temporarily extend their employer-sponsored health plan at group rates in certain circumstances in which their health benefits would otherwise be terminated. Although the federal COBRA law only applies to Colorado employers with 20 or more employees, the state of Colorado has a “mini-COBRA” law that offers a similar continuation of healthcare coverage for employees who work for small businesses with between two and 19 employees.

SSI/SSDI Disability Insurance

Supplemental Security Income (SSI) and Social Security Disability Insurance (SSDI) are both federally-funded benefits programs that make monthly cash payments to disabled individuals who are unable to work. However, there are a number of differences between SSI and SSDI, the most important being the work credit consideration tied to SSDI. While Social Security Disability benefits are only available to severely disabled individuals who have worked long enough and paid Social Security taxes, Supplemental Security Income is a needs-based program offering financial assistance to blind, aged or disabled individuals for basic needs like clothing, food and shelter, regardless of their work history.

To learn more about Federal US employment laws, browse the following topics: