Washington Wage and Hour Laws

Federal and state wage and hour laws exist to protect the rights of workers in Washington and across the United States, and to provide the basic standards for pay and time worked, covering such issues as minimum wage, tips, what counts as time worked, and meal and rest breaks. If you live in Washington, and you believe you have been the victim of a wage and hour law violation, consult a reputable employment law attorney who has experience handling such claims in Washington. A skilled lawyer will use his innumerable resources to thoroughly investigate your claim, and, should he find that you are entitled to financial compensation for unpaid wages or breach of contract, help you navigate the process of filing a lawsuit on your behalf.

Washington Minimum Wage Requirement

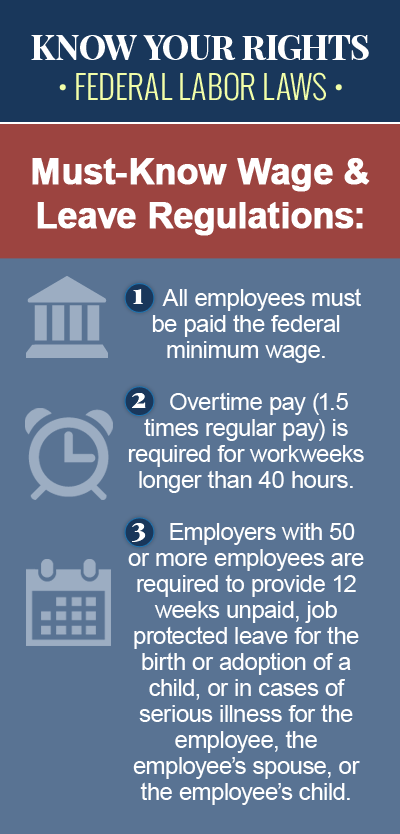

Although the Fair Labor Standards Act (FLSA) sets the federal minimum wage at only $7.25, the minimum wage requirement in the state of Washington is $11.00, and federal law requires that employers subject to two minimum wage laws follow the law that is most generous to the employee. This means that, as of January 2017, nonexempt employees in Washington are entitled to a minimum wage rate of at least $11.00 per hour, and this rate is scheduled to be adjusted annually for inflation based on increases in the consumer price index. Washington’s minimum wage requirement applies to workers in both agriculture and non-agriculture jobs, although workers 14 or 15 years of age may be paid a lower rate, at 85% of the minimum wage.

Minimum Wage for “Tipped” Employees in Washington

In some states, employers are permitted to use tips as credit toward the minimum wages owed to a worker. In other words, an employer can pay an employee who regularly earns tips at work a lower hourly wage, so long as the hourly wage plus the tips earned equals the state minimum wage requirement for each hour worked. This is not the case in Washington, however, and state law requires that Washington employers pay tipped employees the full state minimum wage rate of $11.00, before tips.

Meal Periods and Rest Breaks in Washington

Under Washington wage and hour laws, employees are permitted a paid rest break of at least ten minutes for every four hours worked, and the rest break must be allowed no later than the end of the third hour of the employee’s shift. In some cases, an employer may instead allow an employee to take several “mini” breaks, like smoke breaks, personal phone calls, or snack breaks, which, if the mini breaks total ten minutes, can substitute for a scheduled rest break. For employees scheduled to work more than five hours in a shift, employers must allow at least one 30-minute meal period, which can be unpaid, so long as the employee is not required to perform any work duties during the meal period. Employees in Washington must be paid for their meal period if they are required to remain on duty, are required to be on-call at the business premises, or are called back to duty during the meal period.

Contact a Washington Wage and Hour Law Attorney Today

Understanding your rights as an employee in Washington is important, as you may be entitled to civil remedies for any actions on the part of your employer that violate Washington labor laws. If you have been paid less than the minimum wage rate in Washington, or if your employer failed to pay you for meal periods during which you were required to work, you may be entitled to financial compensation for unpaid wages. Contact a knowledgeable Washington labor law attorney today to explore your legal options.