Washington Employment Law

Employment law, also known as labor law, is a set of rules that are primarily designed to keep employees safe and make sure they are treated fairly in the workplace. State and federal employment law issues can arise in a wide range of situations, and these rules are there to protect employees from discriminatory treatment, unsafe work conditions, unfair labor practices, and more. Whether you are applying for a job or were recently terminated from employment in Washington, it is important that you understand your rights as a worker. Contact an experienced Washington employment law attorney today to discuss your rights.

Wage and Hour Laws

Washington wage and hour laws set the basic standard for minimum wage and other employee concerns, including tips, what counts as time worked, and meal and rest breaks. The minimum wage requirement in Washington is one of the highest in the country, and entitles nonexempt employees in Washington to a minimum wage of $11.00 per hour. Under Washington wage and hour laws, Washington employers are not permitted to use tips as credit towards the minimum wage owed to an employee, and they are required to provide employees with a paid rest break of at least ten minutes for every four hours worked, and a 30-minute meal period, which can be unpaid, for employees scheduled to work more than five hours in a shift.

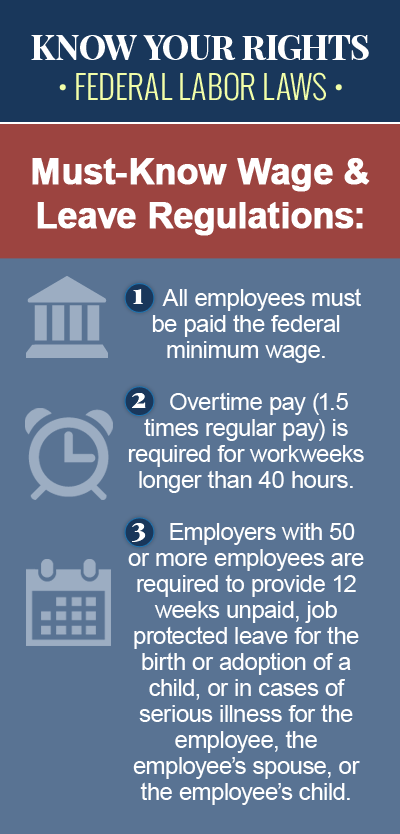

Unpaid Wages and Overtime

There are also wage and hour laws in Washington that dictate how often an employee must be paid for hours worked, and Washington employees who are not paid in full or on time may have grounds to file a wage complaint with the Department of Labor & Industries. Nonexempt employees in Washington who work more than 40 hours in a given workweek are entitled to an overtime rate of one-and-one-half-times their regular rate of pay for each hour worked over 40.

Workplace Discrimination

Under state and federal antidiscrimination laws, it is illegal for an employer in Washington to treat a person or group of people at work differently because of their membership in a protected class. In Washington, protected characteristics include: race, color, creed, age (40 or older), sex (including pregnancy), marital status, disability, national origin, use of a service animal, gender identity, sexual orientation, HIV/AIDS and veteran or military status. The most common types of employment discrimination covered by state and federal law in Washington include discriminatory hiring or firing, sexual harassment, and retaliatory actions taken against employees who exercise their rights by filing a workplace discrimination complaint, participating in a discrimination investigation, or reporting illegal activity on the part of the employer.

Wrongful Termination

A type of employment discrimination, wrongful termination occurs when an employer fires an employee for reasons that violate state and federal antidiscrimination laws. An employee’s termination may be considered wrongful if the action is based on any the protected characteristics named above, is in retaliation for an employee exercising his rights, is in breach of a written, oral or implied employment contract, or is based on an employee taking time off work for certain personal responsibilities or civic obligations.

COBRA Continuation Coverage

COBRA, or the Consolidated Omnibus Budget Reconciliation Act, is a federal law that allows workers in Washington and members of their immediate family to extend their employer-sponsored health plan for a limited period of time in certain circumstances where the coverage would have otherwise ended. COBRA continuation coverage only applies to employees who work for businesses with 20 or more employees, and because there is no state law in Washington that provides a similar continuation of health benefits for employees who work for smaller businesses, Washington employees who lose their group health plans are only eligible for a temporary extension of benefits under the federal COBRA law.

SSI/SSDI Disability Benefits

As in other states, workers in Washington who are unable to work because of a severe physical or mental disability may be entitled to monthly cash payments under the federal Supplemental Security Income (SSI) or Social Security Disability Insurance (SSDI) programs. SSI is a needs-based program that pays monthly benefits to disabled individuals with limited income and resources, while SSDI pays benefits to individuals who worked long enough and paid Social Security taxes before becoming disabled. Individuals in Washington who qualify for SSI benefits may also be eligible for an additional supplemental payment from the state, depending on their living situation.

To learn more about Federal US employment laws, browse the following topics: