Washington Unpaid Wages and Overtime

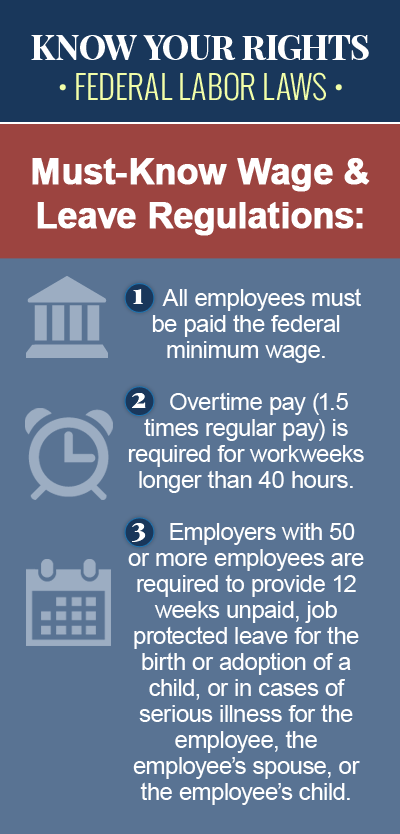

In Washington, there are state and federal laws in place that govern a variety of wage and hour issues in the workplace, including what counts as time worked, when an employee must be paid, and the premium rate employees must be paid for overtime hours. While the Fair Labor Standards Act (FLSA) sets the federal standard for many wage and hour issues in the United States, there are also laws at the state level that provide further protections for employees in the state of Washington. If your employer in Washington has failed to pay you on time or paid you less than the required overtime rate, or if you have been the victim of another wage and hour violation, contact a knowledgeable Washington employment law attorney today for legal help.

Laws Regarding Late and Unpaid Wages

Under Washington wage and hour laws, employers are required to pay workers on regular established paydays at least once a month for “hours worked.” According to the Washington State Department of Labor & Industries, the term “hours worked” refers to “all hours during which the worker is authorized or required by the business to be on the premises or at a prescribed work place. This could include, travel time, training and meeting time, wait time, on-call time, and time for putting on and taking off uniforms, and may also include meal periods.” Workers in Washington who are not paid in full or on time can file a wage complaint with the Department of Labor & Industries. The same is true for workers who are denied other workplace rights regulated by the Department of Labor & Industries, such as overtime wages, family care, and meal and rest breaks. Washington employees who are owed back pay may also have the right to bring an unpaid wages lawsuit against their employer in court.

Overtime Pay in Washington

Most employees in Washington who are paid an hourly wage and work most than 40 hours in a given workweek are entitled to an overtime rate of one-and-one-half-times their regular rate of pay for each hour worked over 40. Although some states also require employers to pay employees overtime for any hours worked over eight in a given workday, this is not the case in Washington. However, there are some types of employees who are considered “exempt” under federal labor law, and are therefore not entitled to overtime pay, including the following categories of workers:

- Newspaper vendors or carriers

- Seasonal employees at agricultural fairs

- Workers employed on farms or ranches

- Forest protection and fire prevention activities

- Vessel operating crews of WA state ferries operated by DOT

- Seamen on American or foreign vessels

- Youth camps with childcare responsibilities

- Public elective or appointive offices

- Inmates, residents or patients of any state, county or municipal correctional, treatment, detention or rehab institutions

- Employees of an air carrier

- Executive, administrative, professional, computer professional and outside sales workers

- Motion picture projectionists

- Volunteers for a profit or nonprofit educational, religious or charitable organization or government agency

- Any worker whose duties require that he or she sleep or reside at the place of employment

Contact a Washington Unpaid Wages Attorney Today

Workers in Washington are entitled to be paid on time and in full for all regular or overtime hours they have worked, and workers who are owed back pay by their employers may have grounds to bring a private unpaid wages or breach of contract lawsuit in court, rather than filing a complaint with the Washington State Department of Labor & Industries. Should you choose this course of action, it’s important to have an attorney on your side who has experience handling unpaid wage claims in the state of Washington, to improve your chances of a favorable outcome in court. Consult a reputable Washington unpaid wage claim lawyer today to learn about your rights and explore your possible compensation options.