Pennsylvania Wage Laws

There are strict requirements under Pennsylvania wage and hour laws that dictate the proper minimum wage, overtime pay, and meal or rest breaks covered, nonexempt employees in PA are entitled to. If you believe you have been the victim of a wage and hour law violation in Pennsylvania, consult an experienced PA employment law attorney today to discuss your legal options. You may have grounds to file a wage and hour lawsuit against your employer in court, in order to recover your unpaid wages and other related losses. In some cases, the court may even require the employer to pay your attorneys’ fees, as well as an additional 25% of the wages you are owed.

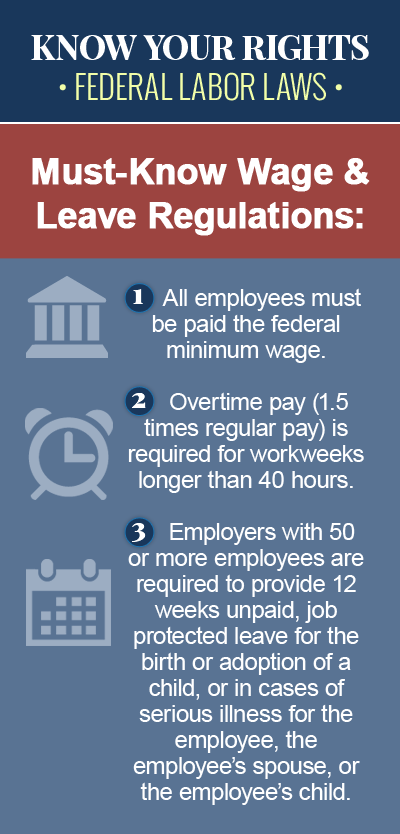

Pennsylvania Minimum Wage

Unlike other states, many of which have set minimum wage requirements above the federal standard, Pennsylvania’s minimum wage is $7.25, equal to the federal minimum wage, and all covered, nonexempt employees in PA are entitled to be paid at least this hourly rate. The following workers, however, are not covered by the state minimum wage law in Pennsylvania:

- Farm workers

- Outside salespersons

- Executive, administrative or professional employees

- Volunteers for educational, religious, charitable or nonprofit organizations

- Employees associated with the publication of any weekly, daily, or semiweekly newspaper with a circulation of less than 4,000

- Domestic workers

- Seasonal employees under 18

- Golf caddies

- Employees of public amusement or recreational establishments

- Switchboard operators for small telephone companies

- Elected officials or employees of elected officials

Pennsylvania employment law does not require employers to provide rest or meal breaks to workers aged 18 and older, but in cases where an employer provides an employee with a break of 20 minutes or less, the employer is required to pay the employee for that time. Employees in PA between the ages of 14 and 17 must receive a 30-minute break for every five consecutive hours worked.

“Tipped” Employees in PA

According to Pennsylvania law, employers are permitted to apply tips against the state minimum wage for “tipped” workers, like waiters, waitresses and bartenders. In this case though, the tip credit an employer is permitted to apply to a worker’s wages may not count for more than 40% of the worker’s total wage. In other words, if a tipped employee is making minimum wage, he or she must be paid at least $2.83 per hour, which, when added to the tips earned, will be equal to the minimum wage requirement of $7.25 per hour.

Overtime Pay in Pennsylvania

Like federal law, wage laws in Pennsylvania require that employees be paid one-and-one-half-times their regular rate of pay for any hours worked over 40 in a given workweek. Any employee who is not covered by Pennsylvania’s minimum wage law (as described above) is also not covered by the state’s overtime requirement. Furthermore, there are some employees who are covered by the PA minimum wage requirement, but who are not covered by the state overtime requirement, including the following:

- Taxicab drivers

- Seamen

- Salespersons, mechanics or parts persons selling and servicing trucks, automobiles, trailers, farm equipment or aircraft

- Movie theater employees

- Motor carrier employees

- Announcers, chief engineers or news editors at small TV and radio stations

- Employees engaged in processing maple sap into sugar or syrup

A Reputable PA Employment Law Attorney Can Help

If your employer owes you wages, or if you have been the victim of a wage and hour law violation in Pennsylvania, you can file a wage and hour claim with the Pennsylvania Department of Wage and Industry, or you can file an individual lawsuit in court, in order to pursue financial compensation for unpaid wages and other losses. Unfortunately, recovering unpaid wages can be a complicated, confusing and frustrating process, and there is a strict statute of limitations in place for the filing of wage and hour claims in PA. For this reason and more, you should contact a knowledgeable employment law attorney in Pennsylvania as soon as possible, to protect your legal rights and to explore your possible compensation options.