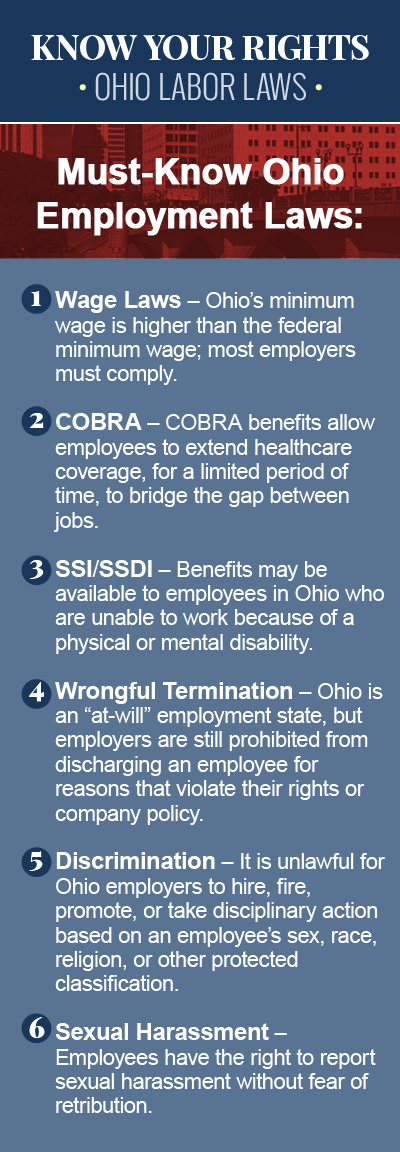

COBRA

Employees in Ohio who lose their jobs, have their hours at work reduced, or experience another qualifying life event that would cause the employee and his or her family to lose their healthcare coverage, may qualify for COBRA benefits, designed to help workers remain covered for a certain period of time, until they are able to secure new employment or get another health insurance plan. In other words, getting fired or laid off from a job in Ohio doesn’t necessarily mean you will no longer receive healthcare coverage. Consult a knowledgeable COBRA insurance lawyer today to learn about your rights, and to ensure that you and your family receive the health benefits you are entitled to.

What is COBRA?

COBRA, which stands for Consolidated Omnibus Budget Reconciliation Act of 1985, is a law that protects workers who lose their employer-sponsored health benefits, by allowing them to continue receiving benefits provided by their group health plan for a limited period of time. In order for the worker to qualify for COBRA, there must be one or more qualifying criteria, such as voluntary or involuntary job loss, divorce or legal separation from the insured employee, death of the insured employee, transition between jobs, reduction in the hours worked, or another significant life event. In most cases, the insurance coverage can be continued for up to 18 months. In the case of a divorce or legal separation, coverage may be extended for up to 36 months.

How Does COBRA Work?

Prior to COBRA, part-time and full-time employees who were laid off lost their health insurance coverage immediately, but since the Act was passed in 1985, employees terminated for any reason other than “gross misconduct” may elect to continue their health benefits, to cover the period of time they are between jobs. Federal law requires that employers continue to make COBRA benefits available to employees, even those who have been involuntarily terminated due to poor performance or inefficiency on the job. Employers are responsible for making the initial COBRA payment, and then it becomes the employee’s responsibility to cover the cost of continuing COBRA insurance coverage.

“Mini-COBRA” Coverage in Ohio

COBRA typically requires that group health plans sponsored by employers with 20 or more employees in the previous year offer workers and their families a temporary extension of health benefits – called continuation coverage – in the event of a qualifying life event that would otherwise result in a loss of coverage. For workers who are laid off at a company with fewer than 20 employees, however, the Ohio continuation state law may apply, which means that while they are not eligible for COBRA benefits, they may still be entitled to extend their employer’s group coverage for up to six months. In Ohio, the state continuation coverage law, sometimes referred to as “mini-COBRA,” dictates that, in order for an employee to be eligible for “mini-COBRA” coverage, he or she must have been:

- Continuously insured under a group policy during the three months before the employment was terminated;

- Not covered or eligible for coverage under Medicare, or under another group coverage; and

- Involuntarily terminated for reasons other than gross misconduct.

Contact an Experienced COBRA Insurance Attorney Today

It is imperative that you know your rights when it comes to your healthcare coverage and COBRA eligibility, especially if you believe you have been unlawfully denied COBRA benefits after losing your job or experiencing another significant life event that has resulted in a loss of healthcare coverage. If you have been laid off in Ohio, and your employer terminated your healthcare coverage without notifying you, or failed to give you proper notice, you may qualify for a continuation of benefits under the Consolidated Omnibus Budget Reconciliation Act of 1985. Contact an experienced COBRA insurance attorney today to discuss your options for legal recourse.