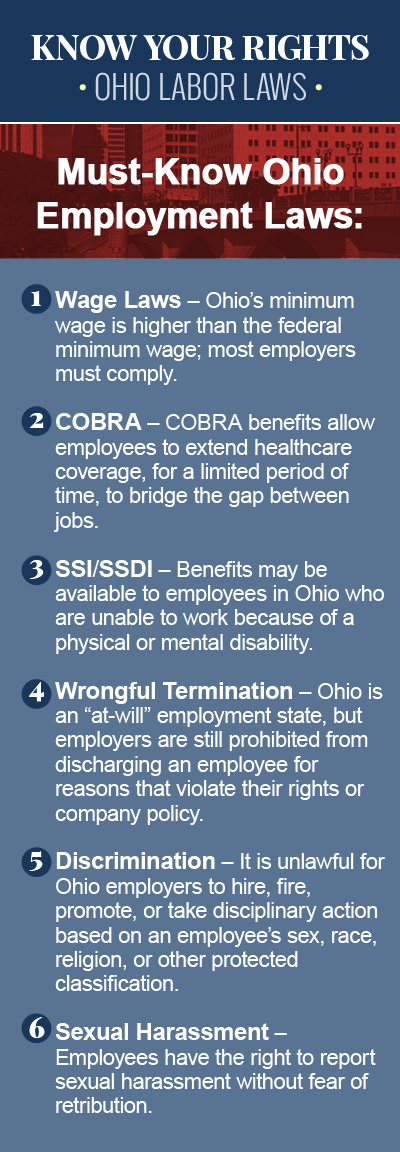

Wage Laws

Wage and hour laws in Ohio set the basic standards for employee pay and time worked, covering issues like minimum wage, overtime pay, tips, and meal and rest breaks for employees. While federal wage and hour laws are overseen by the Department of Labor (DOL) and regulated by the Fair Labor Standards Act (FLSA), much of the wage and hour law is at the state level, and standards often vary on a state-by-state basis. If you believe you have been treated unlawfully by your employer in Ohio, consult a knowledgeable Ohio employment law attorney to discuss your options for recovering the wages and employment status you are due for wage and hour violations.

Minimum Wage Requirements in Ohio

Although there is a federal wage law in effect, some states have their own minimum wage requirements, and in states that have a minimum wage that is higher than the federal standard, employers must comply with the state regulations. In Ohio, for example, the minimum wage requirement is $8.10 per hour for covered, nonexempt employees, compared to the federal minimum wage of $7.25. Small businesses in Ohio with less than $297,000 in gross annual revenue, however, are still permitted to pay employees the federal minimum wage of $7.25 per hour, and Ohio employers are also permitted to pay “tipped” employees a lower hourly minimum wage, as long as that wage combined with the tips he or she earns adds up to at least the state minimum wage for each hour worked.

According to Ohio state law, employers can pay tipped employees an hourly wage of 50% of the minimum wage, as long as the employee’s tips bring the total wage up to $8.10 per hour. Some employees are exempt from Ohio’s minimum wage requirements, including:

- Federal employees

- Newspaper delivery persons

- Babysitters and live-in caretakers

- Students employed by a state or local agency

- Employees or police and fire agencies

- Executives, administrative employees and computer professionals

- Employees for a nonprofit camp or recreational facility for children

- Outside salespersons paid by commissions

- Volunteers of nonprofit organizations

Ohio Overtime Pay and Lunch Breaks

According to federal wage and hour standards, most employers in the United States are required to pay overtime wages to employees who work more than 40 hours in a given workweek. This applies to Ohio, where eligible employees are entitled to overtime pay of one-and-one-half-times the regular rate of pay if they work more than 40 hours in one week, unless the employer grosses less than $150,000 per year, in which case, this overtime requirement does not apply.

Employers in Ohio are not required to provide lunch or rest breaks for employees, although they must pay the employee for any work done during a break, i.e. if they have to answer the phone while they eat lunch. Under Ohio law, employers are also required to give employees under 18 years of age a half-hour break for every five hours they work. Generally, employees are entitled to be paid for any short breaks between five and 20 minutes provided by their employer, as this time is considered part of the work day.

Vacation, Holiday and Sick Leave in Ohio

Ohio law does not require employers to provide employees with vacation benefits, sick leave benefits, or vacation benefits, either paid or unpaid, and in Ohio, a private employer can even require an employee to work holidays without paying a premium wage, unless the extra time qualifies the employee for overtime pay.

A Reputable Ohio Wage and Hour Law Attorney Can Help

As a general rule, an employer who is subject to more than one employment law, i.e. state and federal, must comply with the law that is most generous to the employee. Unfortunately, some employers take advantage of their employees, and fail to pay them for lunch breaks, tip credits, or overtime, or retaliate against them for reporting a violation of their rights as an employee. If you believe you have been the victim of an Ohio wage and hour law violation, contact an experienced employment law attorney today, to discuss your legal options. You may have grounds to file a wage and hour claim with the Ohio Department of Commerce’s Division of Labor and Worker Safety, Wage and Hour Bureau, in order to recover unpaid wages, attorneys’ fees, and other related damages.