Nevada Wage and Hour Laws

Nevada wage and hour laws provide important protections for employees across the state, in terms of minimum wage requirements and paid meal and rest breaks, and offer civil remedies for Nevada employees whose employers fail to pay them the wages they are due. If your employer has paid you less than the minimum wage rate in Nevada, or if you haven’t been paid for your meal or rest breaks, you may have a wage and hour claim against your employer. Consult a knowledgeable Nevada employment law attorney as soon as possible to discuss filing a claim for back pay and other related damages.

Minimum Wage Requirement in Nevada

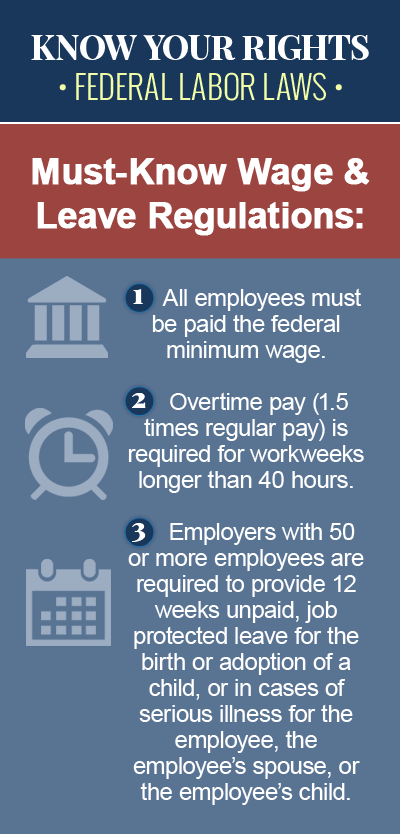

Some states have a minimum wage requirement that is higher than the federal minimum wage, which is $7.25 per hour, and when this is the case, federal law requires that the employer follow the law that is most generous to the employee. In Nevada, the current minimum wage rate is $7.25 – the same as the federal requirement – for employees whose employers provide health benefits. Employees in Nevada who don’t receive health benefits are entitled to a wage of at least $8.25 per hour. Like the minimum wage requirement in other states, these pay rates may be increased annually based on changes in the cost of living index. There are certain employees who are not entitled to the minimum wage under Nevada law, including:

- Taxicab and limousine drivers

- Casual babysitters

- Domestic service employees who reside in the household where they work

- Outside salespeople whose pay is based on commissions

- Agricultural workers

Nevada’s state minimum wage requirement applies regardless of tips, so tipped employees in the state must be paid the same minimum wage, before tips. Employers in Nevada who provide their employees with meals are permitted to count the meals against the minimum wage, but only at the rate of $.35 for breakfast, $.45 for lunch, and $.70 for dinner.

Nevada Meal Breaks and Rest Periods

In states that follow federal law, employers aren’t required to provide employees with meal or rest breaks, but they are required to pay for any short rest breaks and for any meal breaks where the employee is expected to continue working. Nevada, however, is one of the few states where state labor law requires employers to provide employees with both meal breaks and rest periods. In Nevada, employers with two or more employees are required to give their employees a paid 30-minute meal break if they will work for eight or more continuous hours, although an employer may be exempt from this rule if he can prove that business necessity prevents him from granting meal breaks. In addition to meal breaks, Nevada employers with more than two employees are also required to give employees a paid ten-minute rest break for every four hours the employee works, to be provided in the middle of the work period, if possible.

Contact a Nevada Wage and Hour Lawyer Today

If you are an employee in Nevada, there are federal and state laws in effect that protect your rights at work, and entitle you to a minimum hourly wage, plus paid meal and rest breaks. If your employer in Nevada has paid you less than minimum wage, or if you haven’t been paid for meal or rest breaks during the workday, contact an experienced Nevada labor law attorney today for legal help, as you may have grounds to file a wage and hour claim against your employer. There may not be a time limit for filing a wage and hour complaint with the Office of the Labor Commissioner in Nevada, but if you choose to file an action in court, you must do so within two years of the denial of wages, so it’s important to hire an attorney to represent your case as soon as possible.