Nevada Unpaid Wages and Overtime

There are both federal and state labor laws in place that protect the rights of workers in Nevada, requiring the payment of overtime wages, and offering civil remedies for employees who are owed unpaid wages by their employer. Still, failing to pay employees the overtime premium required by law is one of the most common wage violations by employers in the United States. If you believe you are owed back pay for regular hours worked or overtime hours in Nevada, contact an experienced wage and hour attorney today to discuss your legal options. You may have grounds to file an unpaid wages claim against your employer, in order to recover the wages you are due.

Overtime Wages in Nevada

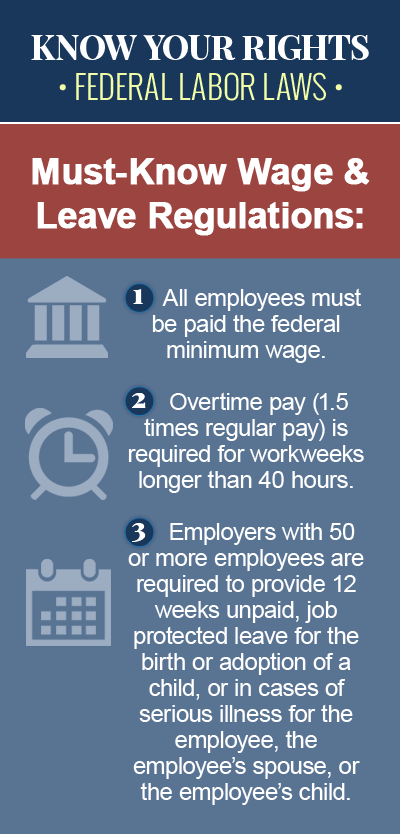

Under the Fair Labor Standards Act (FLSA), employers in Nevada are required to pay nonexempt employees an overtime rate of one-and-one-half-times their regular rate of pay for any hours worked over 40 in a given workweek. According to Nevada labor law, in addition to paying overtime wages to employees who work more than 40 hours in a week, employers must pay nonexempt employees one-and-one-half-times their regular rate of pay for any hours worked over eight in a single workday, so long as they earn less than one-and-one-half-times the minimum wage rate. Some employees, however, fall within an exception to the overtime laws and are considered “exempt,” which means they are not eligible for overtime. Some examples of exempt employees include:

- Administrative employees

- Executive employees

- Computer employees

- Professional employee

- Outside salespersons

- Highly compensated employees

- Drivers of taxicabs or limousines

- Railroad employees

- Air transportation employees

- Agricultural employees

Filing an Unpaid Wages Claim in Nevada

In Nevada, you have two options when pursuing back pay from your employer. You may choose to file a complaint with the Office of the Labor Commissioner, which is responsible for administering Nevada’s wage and hour laws. The Labor Commissioner recommends that employees who have a wage and hour complaint first make a good faith effort to resolve the issue with their employer. Should that effort fail, the Labor Commissioner has the authority to conduct hearings and issue binding decisions on your behalf.

Alternatively, under Nevada law, a private right of action exists for recovering unpaid wages, and employees with a wage and hour complaint may choose to take their claim to court and sue their employer to recover the wages they are owed. If you decide to take your claim to court, you must do so within two years of the denial of wages, and it may be a good idea to hire an attorney who has experience handling Nevada wage and hour claims, to improve your chances of receiving a favorable outcome in your case.

An Experienced Employment Law Attorney Can Help

To calculate how much your unpaid wages claim is worth, take the difference between what you should have been paid per hour and what you were actually paid, and multiply that amount by the total number of hours you worked. For unpaid overtime hours, you would be owed an extra 50% of your hourly rate, on top of your regular pay. If your employer in Nevada has failed to pay you the wages you are entitled to, either for regular hours worked or overtime hours, you may have a valid unpaid wages claim. Consult a skilled Nevada employment law attorney today to discuss your legal options.