Michigan Wage and Hour Laws

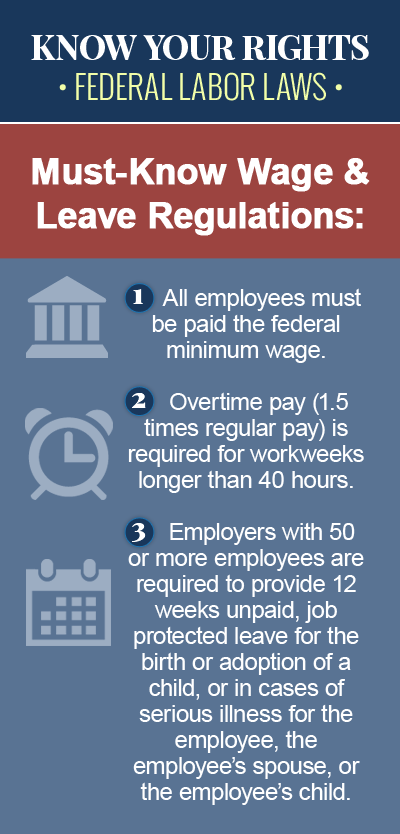

Federal and state wage and hour laws set the basic standards in Michigan for pay and time worked, governing such issues as minimum wage, tip minimum wage, meal and rest breaks, and what is considered “time worked.” The federal wage and hour law is called the Fair Labor Standards Act (FLSA), and employers are required to follow this law with regards to many wage and hour issues, but there are also laws at the state level that provide further protections for employees in Michigan. If you believe you have been the victim of a wage and hour law violation in Michigan, contact a knowledgeable employment law attorney today for legal help. You may have grounds to file a wage and hour claim against your employer, in order to seek reimbursement for unpaid wages and other damages.

Minimum Wage Requirements in Michigan

Effective January 2017, the minimum wage requirement in Michigan is $8.90 per hour, which means nonexempt employees in the state of Michigan are entitled to an hourly rate of at least $8.90, though an additional increase is planned for 2018, which will bring the minimum wage in Michigan up to $9.25. Beginning in April 2019, and every year thereafter, the state of Michigan will increase its minimum wage rate to reflect the average annual change in the consumer price index. Although the federal minimum wage requirement is currently set at only $7.25, federal labor law requires that an employer who is subject to more than one minimum wage law follow the law that is most generous to the employee, which, in the case of Michigan, is the state minimum wage rate.

Michigan Minimum Wage for Tipped Employees

The federal Fair Labor Standards Act (FLSA) allows employers to pay a lower hourly wage to employees who regularly earn tips during the course of employment. As of 2017, Michigan employers can pay tipped employees an hourly wage of only $3.38, so long as the hourly wage plus the tips they earn adds up to at least the full minimum wage rate for each hour worked. If it doesn’t, the employer must make up the difference.

Meal Breaks and Rest Periods in Michigan

Michigan wage and hour laws do not require employers to provide meal breaks or rest periods to employees. However, employees in Michigan are entitled to be paid for any short breaks employers do provide, typically lasting less than 20 minutes, as this time is considered part of the workday. Furthermore, Michigan employees who receive a meal break are entitled to be paid for the break if they are required to perform work duties during the break; for example, if they are asked to cover the phones while they eat their lunch. In order for meal breaks to be unpaid, employers must provide employees with complete relief from their work duties. For an employee under the age of 18, employers in Michigan are required to provide a 30-minute uninterrupted rest period if the employee is scheduled to work more than five continuous hours.

A Skilled Michigan Wage and Hour Law Attorney Can Help

Employees in Michigan have certain rights under state and federal wage and hour laws, and these rights include being paid a fair hourly rate, being paid for meal breaks during which they are required to perform work duties, and other such concerns. Michigan labor law also provides civil remedies for employees who have been the victim of a state or federal wage and hour law violation. If your employer in Michigan has paid you less than minimum wage, or if you were asked to perform work that you were not properly compensated for, consult a skilled Michigan employment law attorney today, to discuss the possibility of filing a wage and hour claim against your employer.