Michigan Unpaid Wages and Overtime

In the state of Michigan, payday requirements, overtime pay, remedies for unpaid wage claims, and other wage and hour concerns are governed by state and federal laws created to protect the rights of employees in the workplace. If you believe your employer in Michigan has not properly paid you, or has underpaid you for regular or overtime hours worked, your first course of action should be to contact a reputable employment law attorney who has experience handling such claims in Michigan. You may be entitled to financial compensation for your unpaid wages and other damages, and a knowledgeable wage and hour law attorney help through the process of filing a claim.

Michigan Payday Requirements

Employers in Michigan have a few options when it comes to how often they pay their employees. They can choose to pay them one time per month, two times per month, once every two weeks, once every week, or even more frequently. However, Michigan employers are required to designate a regular payday so employees know when to expect their paycheck, and, depending on which pay schedule option they choose, there are specific requirements as to when the wages an employee earns must be paid.

If an employer chooses to pay wages twice per month, he must pay employees for all wages earned during the first 15 days of the month, on or before the first day of the following month. For wages earned between the 16th and final day of the month, the employer must pay employees on or before the 15th day of the following month. If an employer chooses to pay wages either once per week, or once every two weeks, he must pay wages within 14 days of the end of the pay period in which the wages were earned. If an employer chooses to pay wages once per month, he must pay employees no later than the first day of the month following the month in which the wages were earned.

Overtime Wages in Michigan

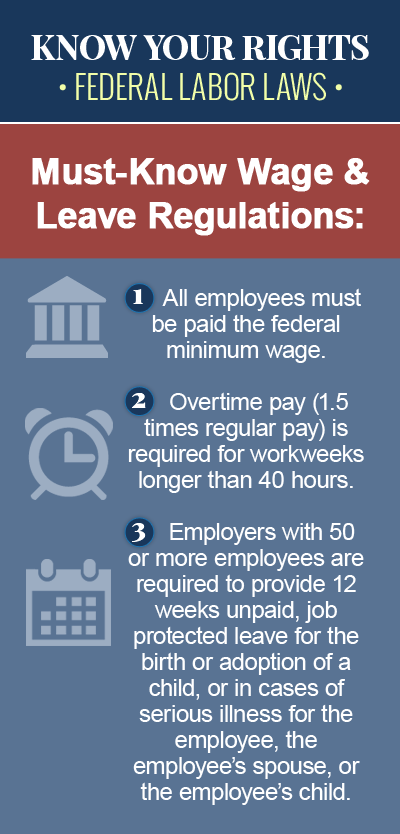

Under Michigan law, eligible employees who work more than 40 hours in a given workweek are entitled to an overtime rate of one-and-one-half-times their regular rate of pay, or their hourly rate plus a 50% overtime premium, for every hour worked over 40. Not every type of employee in Michigan is eligible for overtime wages, however. There are some job categories that fit into an exception of the Fair Labor Standards Act (FLSA), which means they are “exempt” from the federal overtime law and are not entitled to overtime wages, although they may be covered under state law. The following are examples of job categories that are exempt from federal overtime law:

- Independent contractors

- Volunteers

- Executive, professional and administrative employees paid on a salary basis

- Newspaper deliverers

- Outside salespeople

- Employees of seasonal amusement or recreational businesses

- Certain computer specialists

- Employees who work on small farms

- Casual domestic babysitters

- Criminal investigators

- Certain switchboard operators

- Workers engaged in fishing operations

Under Michigan law, there is no overtime requirement for employees who work more than eight hours in a single workday.

Contact an Experienced Michigan Payday Attorney Today

There are state and federal laws in place that provide protections for employees in Michigan, governing the wages employees are entitled to and how frequently they must be paid. Unfortunately, unpaid wage claims and other wage and hour law violations are common in Michigan, and it’s important that employees are aware of their rights when attempting to recover unpaid wages from their employers. If you are owed back pay for overtime hours in Michigan, or if your employer has failed to pay in a timely manner the wages you are due, you may have grounds to file a claim to recover your unpaid wages. Consult a reputable Michigan unpaid wages attorney today to discuss the possibility of filing a wage and hour claim against your employer.