Michigan Employment Law

Employment law, also known as labor law, is an area of the law that covers nearly every aspect of the employee/employer relationship, including hiring, firing, wages and benefits, and also protects employees against wrongful termination, sexual harassment, retaliation and discrimination in the workplace. Michigan employment laws are based on federal and state legislation and constitutions, and provide civil remedies for employees who believe they have been the victim of a labor law violation. If you have been treated unfairly at work, or if you are owed unpaid wages by your employer, you may have grounds to file an employment law claim in court. Contact an experienced Michigan labor law attorney today to discuss your legal options.

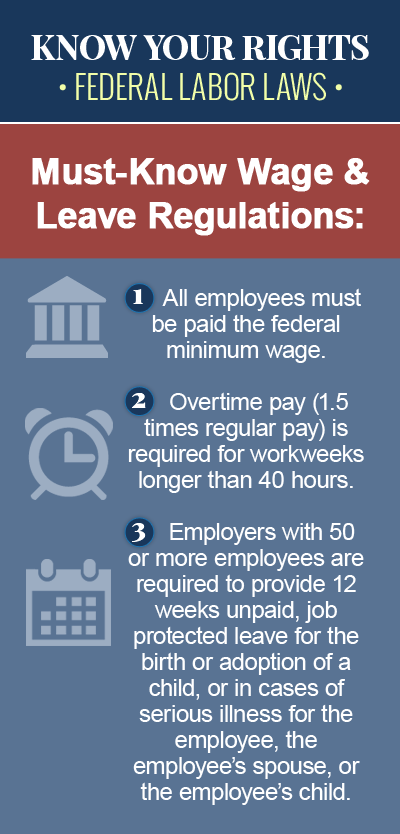

Wage and Hour Law

Michigan wage and hour laws protect the rights of employees across the state, and set the basic standards for pay and time worked, including minimum wage requirements and meal and rest breaks. Under Michigan law, the minimum wage rate is $8.90 per hour, which is significantly higher than the federal minimum wage rate of $7.25 per hour. Employers in Michigan can pay “tipped” employees an hourly wage of $3.38, but only if the tips they earn plus their hourly wage adds up to at least the full minimum wage rate for each hour worked. While Michigan wage and hour laws do not require employers to provide employees with meal or rest periods, employees are entitled to be paid for any short breaks employers do provide, and for any meal breaks during which they are required to continue performing work duties.

Unpaid Wages and Overtime

In addition to regulating and enforcing the minimum wage requirement and other wage and hour concerns, Michigan labor law also entitles nonexempt employees to an overtime rate of one-and-one-half-times their regular rate of pay for any hours worked over 40 in a given workweek, and regulates how often employers are required to pay their employees for regular or overtime hours. Employees in Michigan who are owed back pay by their employer, for regular or overtime hours worked, may have grounds to file an unpaid wages claim against their employer.

Employment Discrimination

Every state has antidiscrimination laws in place that prohibit employers from making employment decisions that have a disproportionate adverse impact on a “protected class,” or a group of people with a shared characteristic who are legally protected from discrimination or harassment on the basis of that characteristic. Under Michigan antidiscrimination laws, workplace discrimination on the basis of an employee or job applicant’s race, color, religion, disability, citizenship status, sex, national origin, age, genetic information, marital status, HIV/AIDS, height, weight or misdemeanor arrest record is considered unlawful. Sexually harassing an employee or retaliating against an employee for exercising his or her rights is also against the law in Michigan.

Wrongful Termination

A form of employment discrimination, wrongful termination occurs when an employer fires an employee for discriminatory reasons based on a protected characteristic, in violation of an employment contract, for taking time off work for a personal responsibility or civic obligation, or in retaliation for exercising his rights as an employee. For example, it is against the law for an employer in Michigan to fire an employee for reporting workplace discrimination to human resources (retaliation), for belonging to a certain religion or national origin (discrimination), for reporting illegal activity on the employer’s part (whistleblowing), or in breach of an employment contract that promises job security.

COBRA Healthcare Coverage

COBRA is a federal law that allows employees in Michigan to extend their employer-sponsored health plan at group rates for a limited period of time in certain circumstances where their healthcare coverage would otherwise end. For a covered employee, a “qualifying event” may include job loss or reduced work hours, while for a former spouse or dependent, a qualifying event may include divorce or legal separation from the covered employee, death of the covered employee, or a loss of “dependent” status under the health plan’s provisions. There is no state healthcare coverage continuation plan in Michigan, which means Michigan employees who lose their health benefits due to a qualifying event are covered solely by federal law.

SSI/SSDI Disability Benefits

Residents of Michigan who are unable to work because of a severe physical or mental disability that is expected to last for at least one year or result in death, may be entitled to disability benefits under the federal Supplemental Security Income (SSI) or Social Security Disability Insurance (SSDI) programs. While SSI is a needs-based program that pays benefits to disabled, blind or elderly individuals with low income and resources, SSDI is only available to individuals who worked long enough before becoming disabled and paid Social Security taxes during that time. Michigan also pays an additional benefit, called State Disability Assistance (SDA), to eligible disabled adults, those 65 years of age or older, and caretakers of disabled individuals.

To learn more about Federal US employment laws, browse the following topics: