Idaho Unpaid Wages and Overtime

The federal Fair Labor Standards Act (FLSA) sets the basic standards for overtime pay and the payment of final wages upon separation from employment, and many states have their own laws in place governing the payment of regular and overtime wages, while also providing civil remedies for employees who are owed back pay by their employers. If your employer has failed to pay you the wages you are due, you may be entitled to financial compensation for back pay, attorney fees, administrative penalties, and other damages. Contact a knowledgeable Idaho labor law attorney today to discuss the possibility of filing an unpaid wages claim against your employer.

Overtime Laws in Idaho

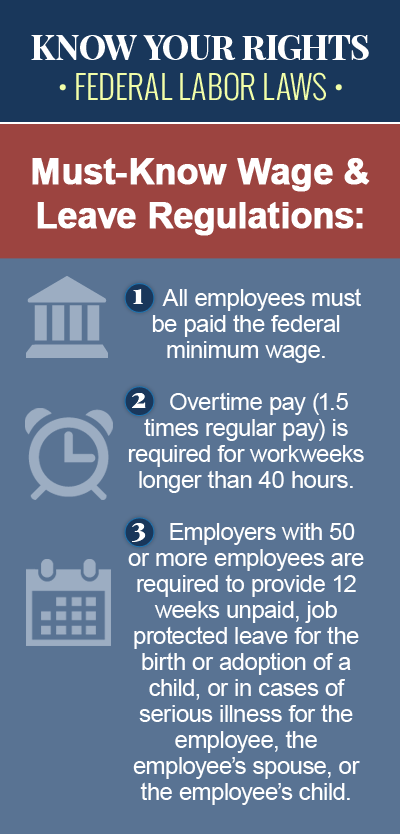

The state of Idaho does not have its own laws governing the payment of overtime wages to employees, which means federal law applies. Under the Fair Labor Standards Act (FLSA), there is no limit to the number of hours an employer in Idaho may require an employee to work in a single workday or workweek. However, nonexempt employees in Idaho who work more than 40 hours in a given workweek are entitled to an overtime rate of one-and-one-half-times their regular rate of pay for all hours worked over 40. Federal law does not require employers to pay a premium rate to employees who work more than eight hours in a given workday, or to those who work on a holiday or weekend day. In some cases, an employer may enter into a contract with an employee that provides a greater obligation for overtime compensation than the FLSA requires, in which case that obligation must be met. According to the FLSA, the following job categories are considered “exempt,” and are therefore not covered under the provisions of the federal overtime law:

- Executive, administrative and professional employees

- Outside salespersons

- Employees in certain computer-related occupations

- Employees of certain seasonal amusement or recreational establishments

- Employees of certain small newspapers

- Employees engaged in newspaper delivery

- Employees engaged in fishing operations

- Casual babysitters

- Individuals employed as companions to the elderly or infirm

- Certain commissioned employees of retail or service establishments

- Employees of railroads and air carriers

- Farm workers

- Auto, truck, farm implement, trailer, boat or aircraft salesworkers

Idaho Unpaid Wage Claims

Employers in Idaho have the right to change your rate of pay at any time, unless you are covered by some sort of pay guarantee or labor agreement. However, you must be notified of any reduction in your rate of pay prior to performing the work for which you are being paid. Although your paycheck may be considered notification of a pay reduction, if the work has already been performed, you may have grounds to file a claim for the difference in wages. According to the Idaho Department of Labor, in order to file a claim against your employer for unpaid wages, you must provide proof of the following:

- You were an employee and not an independent contractor

- Your rate of pay

- The actual hours worked

- The identity and address of your employer

- The amount of unpaid wages owed to you by your employer

If an employee in Idaho quits, is terminated or is laid off, final wages must be paid to the employee on the next regularly scheduled payday, or within 10 days of the separation, whichever comes first. If after the separation occurs, the employee gives the employer a written request for earlier payment of final wages, the employee must be paid within 48 hours of the request being received by the employer.

Contact a Knowledgeable Idaho Labor Law Attorney Today

Despite strict state and federal laws governing the payment of overtime and final wages in Idaho, failure to pay employees the regular or overtime wages they are due is one of the most common labor law violations on the part of employers. Fortunately, there are protections in place for Idaho employees who are owed back pay by their employers, either for overtime hours or final wages. If you have attempted to collect your wages on the usual day of payment and your employer refuses to pay you, if you have not been paid all the wages you are owed for work you have performed, or if you have not received your final paycheck after quitting, being terminated or being laid off, you may have grounds to bring an unpaid wages claim against your employer in court. Contact a knowledgeable Idaho employment law attorney today to discuss your options for legal recourse.