Idaho Employment Law

In the state of Idaho, there are strict laws in place that govern nearly every aspect of the employee/employer relationship, including minimum wage, overtime pay, meal and rest breaks, healthcare coverage and disability benefits. Idaho employment laws, or labor laws, also protect the rights of employees in the workplace, shielding them against unlawful employment discrimination and wrongful termination. If you believe you have been the victim of an employment law violation in Idaho, consult a knowledgeable attorney as soon as possible for legal help. You may be entitled to financial compensation for your losses, which an experienced Idaho employment law attorney can help you pursue.

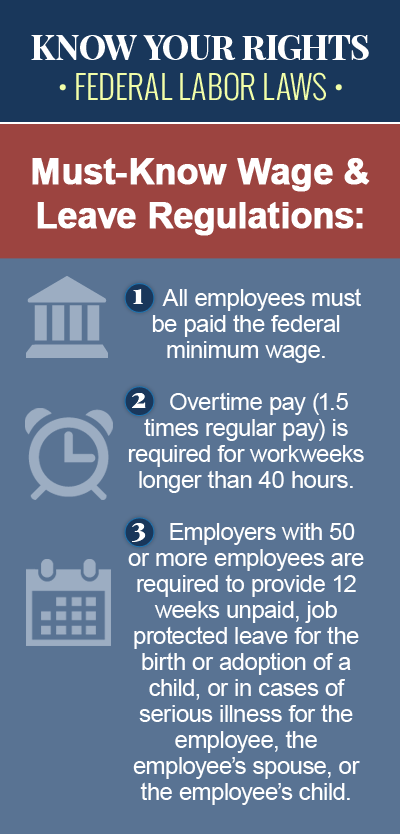

Wage and Hour Laws

Idaho wage and hour laws set the basic standards for minimum wage, tips, meal and rest breaks, and other wage and hour concerns affecting Idaho employees. In the state of Idaho, the minimum wage requirement is currently the same as the federal minimum wage, and employees in Idaho are entitled to a minimum hourly wage of $7.25, unless they are considered “exempt” under the Idaho Minimum Wage Law. Neither Idaho state law nor the federal Fair Labor Standards Act (FLSA) requires Idaho employers to provide employees with meal or rest breaks, but if they choose to do so, meal periods during which the employee is free from all work duties can be unpaid, while short rest breaks typically lasting between five and 20 minutes must be paid.

Unpaid Wages and Overtime

Idaho does not have its own laws governing the payment of overtime wages, which means the federal overtime law applies. Under the FLSA, employees in Idaho who work more than 40 hours in a given workweek are entitled to a premium wage rate of one-and-one-half-times their regular rate of pay for every hour worked over 40. If an Idaho employer fails to pay his employee the wages he has earned for regular or overtime hours worked, or refuses to pay the employee his final wages in a timely manner, the employee may have grounds to file a claim against the employer for unpaid wages.

Workplace Discrimination

Workers in Idaho who believe they have been the victim of unlawful discrimination or retaliation at work, either on the basis of a protected characteristic, or because they engaged in a protected activity, may have a claim for workplace discrimination against their employer. Discrimination in employment can take place in any part of the employee/employer relationship, including hiring, promotions, pay, discipline and firing (wrongful termination), and occurs when an employer makes an employment decision that has a disproportionate adverse impact on members of a protected class.

Wrongful Termination

Wrongful termination, a type of employment discrimination, occurs when an Idaho employer fires an employee for reasons that violate public policy, an employment contract, or state or federal antidiscrimination laws. Even though Idaho, like most states, is an “at-will” employment state, meaning employers have the right to terminate the employment relationship at any time and for any reason, or for no reason at all, there are important exceptions to this rule that prevent employers from firing an employee based on his membership in a protected class or on his participation in a protected activity.

COBRA Continuation Coverage

Employees in Idaho and certain members of their family who lose their employer-sponsored healthcare coverage due to a qualifying event, such as job loss or a reduction in work hours, may be able to temporarily extend their health plan at group rates under a federal law known as the Consolidated Omnibus Budget Reconciliation Act (COBRA). The federal COBRA law applies to employers with 20 or more employees, and allows employees who would otherwise lose their health benefits to continue their coverage for a maximum duration of 18 to 36 months.

SSI/SSDI Disability Benefits

Supplemental Security Income (SSI) and Social Security Disability Insurance (SSDI) are federal programs that pay monthly benefits to individuals who are unable to secure gainful employment because of a severe physical or mental disability. While SSDI benefits are based on the number of “credits” a worker earned before becoming disabled, the SSI program is a needs-based program that makes cash payments to disabled, blind or aged individuals with little income and resources. The state of Idaho also pays an additional monthly payment to SSI recipients, to supplement the federal SSI payment.

To learn more about Federal US employment laws, browse the following topics: