Idaho Wage and Hour Laws

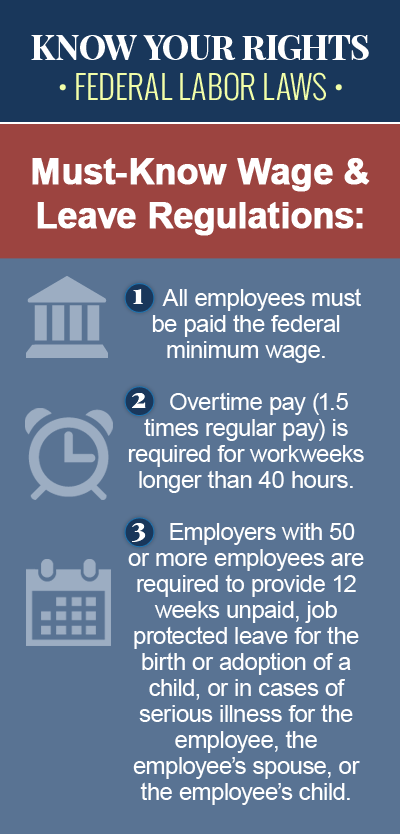

Idaho wage and hour laws set the basic standards for pay and time worked in Idaho, covering such issues as minimum wage, meal and rest breaks, tips, and what counts as time worked, among other wage and hour concerns. Although the Fair Labor Standards Act (FLSA) has established certain federal wage and hour regulations that employers across the United States are required to follow, most states have their own wage and hour laws, as do some local governments. And when they are subject to more than one wage and hour law, employers are required follow the law that is most generous to their employees, which is why it’s important to be aware of the wage and hour laws that apply to you. Contact an experienced employment law attorney today, if you believe you have been the victim of a wage and hour law violation in Idaho.

Minimum Wage Laws in Idaho

Although some states set the minimum wage at a rate that is higher than the federal requirement, the current minimum wage rate in Idaho is the same as the federal minimum wage – $7.25 per hour. This means that employees in Idaho are entitled to an hourly minimum wage rate of $7.25, unless they are exempt from the Idaho Minimum Wage Law. The following job categories are considered “exempt” under the Idaho Minimum Wage Law:

- Executive, administrative or professional employees

- Employees engaged in domestic service

- Outside salespersons

- Seasonal employees of a nonprofit camping program

- Any child under the age of 16 working part-time or at odd jobs not exceeding four hours per day with any one employer

- Certain individuals employed in agriculture

Minimum Wage for “Tipped” Employees in Idaho

In Idaho, a “tipped” employee, or any employee engaged in an occupation in which he or she customarily and regularly receives more than $30 in tips per month may be paid a minimum tipped wage of $3.35 per hour, so long as the employee’s tips combined with the cash wage equals the minimum hourly wage of $7.25. If it doesn’t, the employer is required to make up the difference. New employees in Idaho under 20 years old may be paid a training minimum wage of $4.25 per hour for the first 90 calendar days of their employment.

Idaho Meal and Rest Breaks

Neither Idaho state law nor the federal FLSA requires employers to provide employees with meal periods or rest breaks during the workday. However, if an employer in Idaho chooses to do so, rest breaks, typically lasting between five and 20 minutes, must be paid, as this time is considered part of the workday. Meal periods, typically lasting 30 minutes or more, can be unpaid, so long as the employee is free from all work duties during this time. If the employee is required to remain at the workplace or continue working during the meal period – for example, if the employee is expected to answer the phones while eating lunch – the meal period must be paid.

A Reputable Idaho Wage and Hour Law Attorney Can Help

It is important that employees in Idaho understand how state and federal wage and hour laws apply to them, as that is the only way they can know whether they have been the victim of a wage and hour law violation, and, if they have, what civil remedies they may be entitled to. If, for example, your employer has failed to pay you the minimum wage rate in Idaho, or if you haven’t been paid for meal periods during which you were required to work, you should consult a reputable Idaho wage and hour law attorney as soon as possible. You may have grounds to file wage and hour claim against your employer in court, in order to pursue the compensation you deserve for your unpaid wages and other losses.