Georgia Wage and Hour Laws

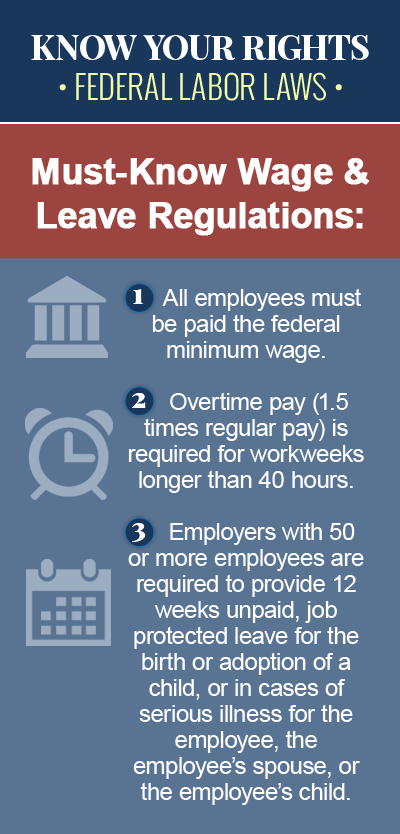

Wage and hour laws in Georgia set the basic standards for pay and time worked, covering such issues as minimum wage, meal and rest breaks, and what counts as time worked. And while there are federal regulations in place regarding wage and hour issues in Georgia, some of these laws are governed at the state level, which is why it’s important to understand you rights as an employee in Georgia. If your employer has paid you less than the federal minimum wage rate, or if you weren’t properly paid for a meal period during which you were required to work, you may have a wage and hour claim against your employer. Contact a knowledgeable Georgia wage and hour law attorney today to discuss your legal options.

Georgia Minimum Wage Requirement

Unlike other states that have set the minimum wage requirement at a rate higher than that required by federal law ($7.25), the official minimum wage rate for nonexempt employees in Georgia is only $5.15 per hour. However, because federal law requires that employers subject to more than one minimum wage regulation follow the law that is most generous to the employee, nonexempt employees in Georgia are entitled to the higher federal rate of $7.25 per hour.

Minimum Wage for “Tipped” Employees in GA

There are a separate set of rules in place that govern the legal rights of employees in Georgia who regularly receive tips as part of their compensation, called “tipped” employees. In many states, for example, employers can claim a “tip credit,” meaning they can pay tipped employees a lower minimum wage, so long as the hourly wages plus the tips they earn adds up to the federal minimum wage requirement of $7.25 for each hour worked. In Georgia, which follows federal law, the tip credit is $5.12 per hour, which means employers are permitted to pay tipped employees a minimum wage of $2.13 per hour. However, if the employee’s hourly wage plus tips doesn’t add up to at least $7.25 per hour, the employer is required to make up the difference.

Meal and Rest Breaks in Georgia

The state of Georgia does not have any laws in place requiring employers to provide employees with meal periods or rest breaks, thus the federal rules apply. As such, employers in Georgia are not required to provide any meal or rest breaks to employees. However, if an employer chooses to do so, employees are entitled to be paid for any meal periods (usually 30 minutes or more) during which they are required to continue their work duties during the break. In general, Georgia employees may also be entitled to pay for any short breaks between five and 20 minutes that the employer provides, as this time is considered part of the work day.

A GA Wage and Hour Law Attorney Can Help

Not all employees in Georgia understand the full extent of their rights under federal and state wage and hour laws, and this puts them at risk for being unfairly treated by their employers, either by being paid less than the federally-mandated minimum hourly wage, or by being required to continue working during meal periods without pay, among other wage and hour law violations. If you believe you have been the victim of a wage and hour law violation in Georgia, consult an experienced GA employment law attorney as soon as possible. With a qualified lawyer on your side, you can ensure that your legal rights are protected while you pursue the compensation you are entitled to.