Georgia Unpaid Wages and Overtime

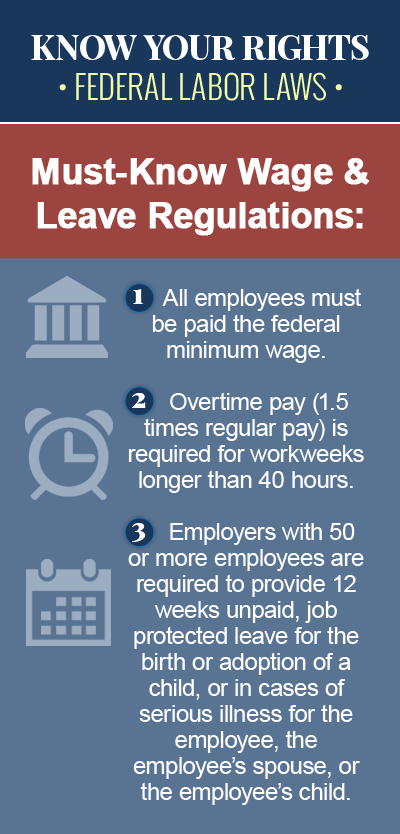

Being that Georgia has not passed its own wage and hour laws, Georgia employers are required to comply with the federal Fair Labor Standards Act (FLSA), which governs the payment of regular and overtime wages to employees. This means that employers in Georgia are bound by federal law to pay any nonexempt hourly employees a premium rate for overtime hours worked, and to pay them on time, and any employer who fails to do so may be in violation of federal and state labor laws. If you believe you are owed back pay from your employer for regular or overtime hours worked, consult an experienced Georgia unpaid wages attorney for legal help. You may have grounds to file an unpaid wages claim against your employer, in order to recover the compensation you deserve for your losses.

Georgia Overtime Requirements

Many hourly employees in the United States are entitled to a premium rate of pay for any hours worked over 40 in a single work week, and while the state of Georgia does not have any overtime laws in place, certain employees in Georgia may still be eligible for overtime pay under the federal FLSA. According to the FLSA, nonexempt employees are entitled to an overtime rate of one-and-one-half-times their regular rate of pay for every hour worked over 40 in a single workweek. Some states also have a daily overtime limit that entitles any employee who works for more than a certain number of hours in a single work day to be paid overtime, but this is not the case in Georgia. Keep in mind that there are certain exceptions to federal overtime laws, and employees in the following job categories may not be eligible for overtime pay:

- Executive, administrative and professional employees paid on a salary basis

- Volunteers

- Independent contractors

- Employees of seasonal amusement or recreational businesses

- Certain computer specialists

- Outside salespeople

- Employees of organized camps, or religious or nonprofit educational conference centers

- Newspaper deliverers

- Criminal investigators

- Casual domestic babysitters

- Seamen

- Workers engaged in fishing operations

- Employees who work on small farms

- Certain switchboard operators

Claims for Unpaid Wages in Georgia

In Georgia, employers are required to follow federal laws dictating the rights of nonexempt employees to earn a certain hourly rate for regular hours worked, and a premium rate for overtime hours. Unfortunately, failing to pay employees properly for overtime hours worked is one of the most common wage violations by employers. If you are entitled to a premium pay rate for overtime hours, and your employer has failed to pay you, your unpaid wages are the difference between what you should have been paid and what you were actually paid. Similarly, if your employer has failed to pay you for any short breaks during the work day, or any meal periods during which you were still expected to perform your work duties, you can calculate the wages you are owed by adding up how much time you spent on rest breaks that should have been paid, and on meal periods that you were required to work through, and then multiplying this extra time by your hourly rate.

An Experienced Unpaid Wages Attorney Can Help

Under state and federal employment laws, an employee in Georgia can bring an unpaid wages claim in court if he or she is paid less than the minimum wage, or is owed back pay for overtime hours, in order to recover compensation for unpaid wages, liquidated damages, attorney’s fees and other associated costs. If you haven’t been paid properly by your employer, you may have a claim for unpaid wages. Contact a knowledgeable Georgia employment law attorney today to discuss your legal options.