Georgia Employment Law

Employment law, also referred to as labor law, is an area of the law that governs nearly every aspect of the employee/employer relationship, designed to keep workers safe from harm and ensure that they are treated fairly in the workplace, in terms of wages, hours, overtime, insurance and legally-protected personal characteristics. If you believe you have been the victim of employment discrimination in Georgia, if your employer failed to pay you minimum wage, or if you have been wrongfully terminated for reasons that violate your right to fair and equal treatment in the workplace, you may have grounds to file a claim against your employer for financial compensation. Contact an experienced Georgia employment law attorney as soon as possible to discuss your legal rights.

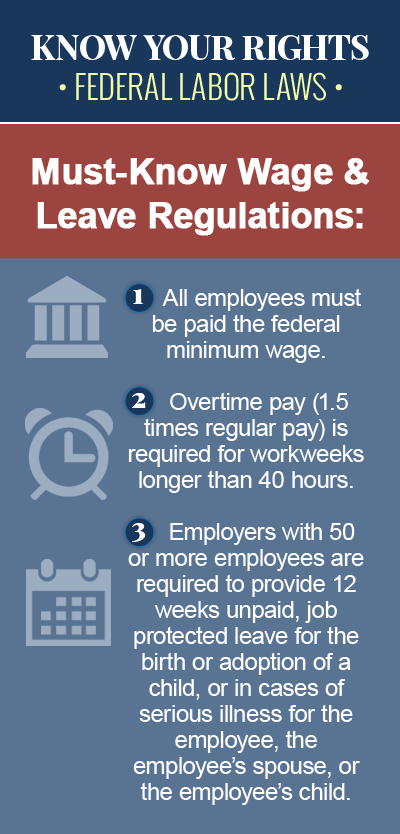

Wage and Hour Laws

Georgia wage and hour laws set the basic standards for pay and time worked, governing important issues like minimum wage and meal and rest breaks, and employers in Georgia who are subject to more than one wage and hour law are required to follow the law that is most generous to the employee. In Georgia, for example, the minimum hourly wage is $5.15, but federal law has set the minimum hourly wage requirement at $7.25, which means nonexempt employees in Georgia are entitled to a rate of at least $7.25 per hour. Employers in GA are not required to provide employees with any meal or rest breaks, but any rest breaks they do provide must be paid, as must any meal periods during which the employee is required to continue working.

Unpaid Wages and Overtime

The state of Georgia does not have any overtime laws in place, which means employers are required to follow the federal law requiring employers to pay employees who work more than 40 hours in any given workweek an overtime rate of one-and-one-half-times their regular rate of pay for each hour worked over 40. Employees who are owed back pay for regular or overtime hours worked may have a claim for unpaid wages against their employer.

Workplace Discrimination

Workplace discrimination occurs when an employer treats a person or group of people at work differently because of their membership in a protected class, and there are state and federal laws in place that protect employees in Georgia from unfair or unfavorable treatment based on a legally-protected characteristic, like race, color, disability, religion, sex or national origin. Discrimination can take place in any part of the employment relationship, including hiring, firing (wrongful termination), promotion and wages, and can also take the form of harassment or retaliation against an employee for exercising his rights.

Wrongful Termination

Employment in Georgia is considered “at will,” which means employees can be fired at any time and for any reason, or for no reason at all. However, when an employee is fired from work because of a protected characteristic, in violation of an employment contract promising job security, or in retaliation for taking part in a protected activity, this is considered wrongful termination. The same protected characteristics covered under state and federal antidiscrimination laws also apply to cases of wrongful termination.

COBRA Continuation Coverage

There are state and federal laws in place in Georgia that give employees, former employees, spouses, former spouses and dependents the right to temporarily extend their group health insurance plan under certain specific circumstances where their coverage would otherwise end. The federal Consolidated Omnibus Budget Reconciliation Act (COBRA) applies to employers in Georgia with 20 or more employees, and offers a temporary continuation of healthcare coverage for between 18 and 36 months, and Georgia’s “mini-COBRA” law offers similar continuation coverage for employers with between two and 19 employees, but only for three months. Under state and federal law, “qualifying events” for continuation coverage include job loss, reduced work hours, and death of the covered employee, among other specific events.

SSI/SSDI Disability Insurance

Supplemental Security Income (SSI) and Social Security Disability Insurance (SSDI) are federal disability benefit programs created to provide financial assistance to individuals in Georgia who are unable to work due to a severe physical or mental disability. The SSDI program is a payroll tax-funded program that pays benefits to individuals with a qualifying disability who worked long enough and recently enough to be “insured,” while the SSI program is based on financial need, and pays monthly benefits to disabled, blind or aged individuals with little income or resources. In Georgia, recipients of SSI benefits also automatically receive an additional state payment intended to supplement the federal payment.

To learn more about Federal US employment laws, browse the following topics: