California Unpaid Wages and Overtime

The federal Fair Labor Standards Act (FLSA) and California’s Labor Code and Industrial Welfare Commission laws are designed to protect the wages and salaries of workers, regulating how much in wages employees are owed, when they must be paid, and what remedies they are entitled to for unpaid wages. If your employer owes you unpaid wages, or if you have been denied the required overtime pay in California, contact an experienced employment law attorney today for legal help. You may have grounds to file an unpaid wages claim against your employer, in order to recover damages for unpaid wages, overtime compensation, interest on unpaid wages, reasonable attorney’s fees, and the cost of a lawsuit.

Late and Unpaid Wages

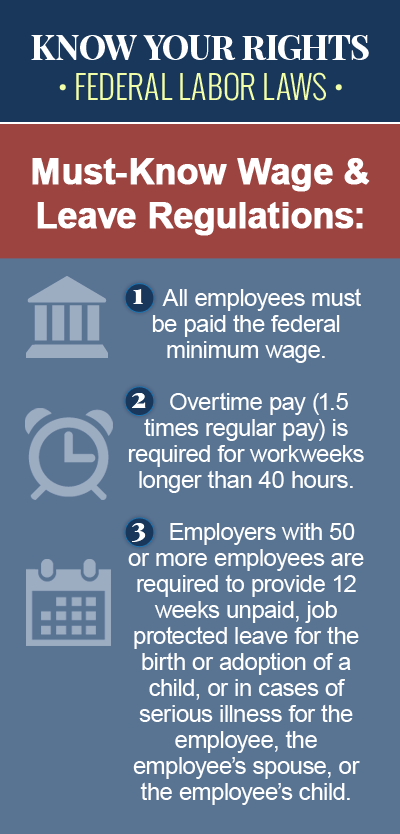

There are federal laws in place that protect the rights of employees in receiving the wages and compensation they are owed, and California also has laws at the state level that require employers to pay their employees on time. Under the California Labor Code, hourly employees must be paid all owed wages once per month if they are an administrative, executive or professional employee covered by the FLSA. For employees entitled to pay twice per month, payment must be made on pay days between the 16th and 26th of the month for work completed between the 1st and 15th, and on pay days between the 1st and 10th of the following month for work completed between the 16th and the end of the month. Any wages paid after these times are considered late.

Overtime Pay in California

Under California law, covered employees are entitled to overtime pay of one-and-one-half-times the regular rate of pay for any hours worked over eight (up to and including 12) in any given workday, any hours worked over 40 in a given workweek, and for the first eight hours worked on the seventh consecutive day of work in a workweek. California overtime law also dictates that these employees are entitled to double the regular rate of pay for any hours worked over 12 in a workday, and for any hours worked over eight on the seventh consecutive day of work in a single workweek.

Employees vs. Independent Contractors

The most important factor to consider in regards to the extent of a worker’s right to wages or benefits in California is whether the worker is classified as an “employee” or an “independent contractor.” In most cases, only employees, not independent contractors, have a legal claim to unpaid wages or overtime compensation from their employer. The difference between an employee and independent contractor in California is based several factors, including the following:

- Whether the worker has the right to control the manner and means of performance

- Whether the employment relationship may be terminated at will

- The degree of skill required to perform the work

- Whether the worker may hire and fire others

- The length of time for which services are to be performed

- Who provides the tools and place of work

- The method of payment, whether by time or by the job

- The degree of permanence of the working relationship

An Experienced Employment Law Attorney Can Help

Under California law, it is illegal for employers to not make full payment of wages on time, but unpaid wage disputes remain a common occurrence for employees in California. Fortunately, while federal law and California law provide different levels of protection and remedies for unpaid workers, the law that applies to your claim will be the law that offers the most protection. If you believe you are owed unpaid wages or overtime compensation in California, your first course of action should be to enlist the help of a qualified employment law attorney who can ensure that you understand your rights as an employee, and help you navigate the process of filing an unpaid wages claim against your employer.