Are you a victim to Unlawful Termination or Wage and Hour Violations?

Employment law is an area of the law that covers nearly every aspect of employer/employee relationships, and while there are federal standards in place that establish and enforce the rights of workers in California and across the country, much of the law protecting employees from discriminatory treatment, unfair labor practices and unsafe working conditions is regulated at the state level. For employees in California who have been the victim of workplace discrimination, who are owed unpaid wages by their employers, or who are entitled to SSI or SSDI benefits because of a severe disability, compensation may be available. Contact an experienced California employment law attorney through the California Employment Law Help Center as soon as possible to discuss your options for legal recourse.

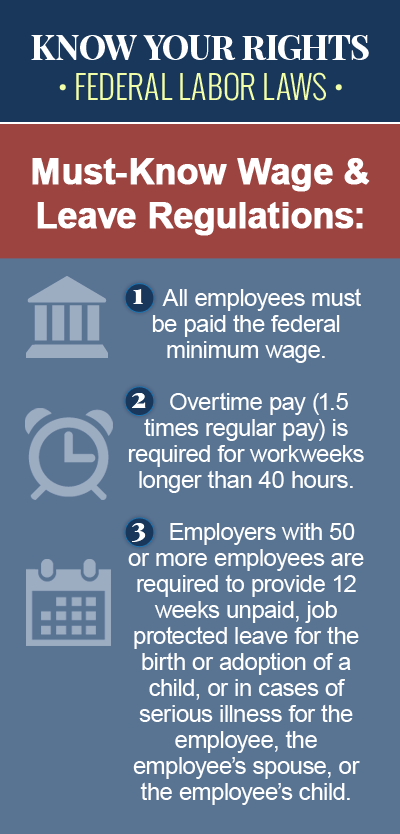

Wage and Hour Laws

Wage and hour laws in California set the basic standards for employee pay and time worked, including minimum wage requirements, overtime pay, tips, and meal and rest breaks. Although the Fair Labor Standards Act (FLSA) establishes federal requirements for minimum wage for employees across the United States, the state of California has its own wage and hour laws, which have set the minimum wage requirement for CA employees at $10. And while other states allow employers to pay “tipped” employees a lower minimum wage, as long as the tips they earn plus their hourly wage is equal to the minimum wage requirement for every hour worked, California actually entitles tipped employees to the full $10 minimum hourly wage.

Unpaid Wages and Overtime

California wage and hour laws also dictate when employees must be paid, and how much they are entitled to for overtime pay, which applies to any hours worked over eight in a given workday, any hours worked over 40 in a given workweek, and the first eight hours worked on the seventh consecutive day of work in a workweek. Under California law, covered employees are entitled to one-and-one-half-times their regular rate of pay for overtime hours, and employers are required to pay employees the wages and compensation they are owed on time, or else be subject to an unpaid wages claim.

Workplace Discrimination

There are federal and state laws in place that prohibit discrimination in the workplace on the basis of protected characteristics, which include, but are not limited to, sex, race, national origin, marital status and physical disability. Employees in California who suffer disparate treatment discrimination, disparate impact discrimination, harassment, or another type of unlawful, offensive or retaliatory treatment in the workplace because of their membership in a protected class may have grounds to file a discrimination claim against their employer or supervisor.

Wrongful Termination

Wrongful termination in California occurs when a worker is terminated from employment because of his or her membership in a protected class. Although California, like many states, is an at-will state, meaning employers can terminate the employee/employer relationship at any time and for any reason, it is against the law for an employer to fire an employee on the basis of a protected characteristic, such as race, age, religion, gender identity or political affiliation. Wrongful termination may also be argued if an employee is fired for refusing to do something illegal or for reporting unsafe working conditions to a government agency or law enforcement, as a whistleblower.

COBRA Healthcare Coverage

COBRA continuation healthcare coverage is a federal law that allows workers with employer-sponsored group health plans who have lost their jobs or had their hours reduced, to temporarily extend their health benefits for up to 18 months, while they are between jobs. COBRA coverage only applies to employers with group health plans that cover 20 or more employees, but the state of California also has its own Cal-COBRA coverage program, which extends the same benefits to workers with employer-sponsored health plans that cover between two and 19 employees, and allows workers to keep their benefits for an additional 18 months, for a total of 36 months.

SSI/SSDI Benefit Programs

Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) are federally-funded programs that pay cash benefits to individuals who are unable to work because of a severe physical or mental disability. SSDI benefits are paid to California employees who worked long enough and paid Social Security taxes prior to becoming disabled, while SSI benefits are available to disabled or blind individuals who have limited income and resources, regardless of their prior work history. The state of California also has a State Disability Insurance (SDI) program, which pays benefits to employees who are unable to work because of a disability or a pregnancy, or who take time off work to care for a sick relative or to bond with a new child.